United Healthcare 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

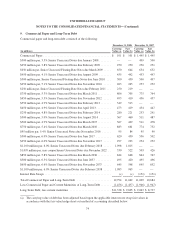

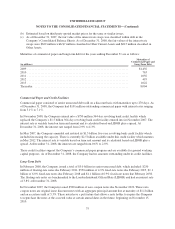

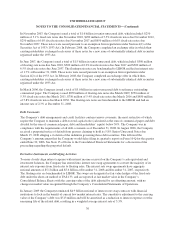

In November 2007, the Company issued a total of $1.6 billion in senior unsecured debt, which included: $250

million of 5.1% fixed-rate notes due November 2010, $450 million of 5.5% fixed-rate notes due November 2012,

$250 million of 6.0% fixed-rate notes due November 2017 and $650 million of 6.6% fixed-rate notes due

November 2037. These notes were issued pursuant to an exemption from registration under Section 4(2) of the

Securities Act of 1933 (1933 Act). In February 2008, the Company completed an exchange offer in which then-

existing noteholders exchanged each series of these notes for a new issue of substantially identical debt securities

registered under the 1933 Act.

In June 2007, the Company issued a total of $1.5 billion in senior unsecured debt, which included: $500 million

of floating-rate notes due June 2010, $500 million of 6.0% fixed-rate notes due June 2017 and $500 million of

6.5% fixed-rate notes due June 2037. The floating-rate notes are benchmarked to LIBOR and had an interest rate

of 1.7% at December 31, 2008. These notes were issued pursuant to an exemption from registration under

Section 4(2) of the 1933 Act. In February 2008, the Company completed an exchange offer in which then-

existing noteholders exchanged each series of these notes for a new issue of substantially identical debt securities

registered under the 1933 Act.

In March 2006, the Company issued a total of $3.0 billion in senior unsecured debt to refinance outstanding

commercial paper. The Company issued $650 million of floating-rate notes due March 2009, $750 million of

5.3% fixed-rate notes due March 2011, $750 million of 5.4% fixed-rate notes due March 2016 and $850 million

of 5.8% fixed-rate notes due March 2036. The floating-rate notes are benchmarked to the LIBOR and had an

interest rate of 2.3% at December 31, 2008.

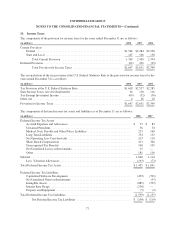

Debt Covenants

The Company’s debt arrangements and credit facilities contain various covenants, the most restrictive of which

require the Company to maintain a debt-to-total-capital ratio (calculated as the sum of commercial paper and debt

divided by the sum of commercial paper, debt and shareholders’ equity) below 50%. The Company was in

compliance with the requirements of all debt covenants as of December 31, 2008. In August 2006, the Company

received a purported notice of default from persons claiming to hold its 5.8% Senior Unsecured Notes due

March 15, 2036 alleging a violation of the indenture governing those debt securities. This followed the

Company’s announcement that the Company would delay filing its quarterly report on Form 10-Q for the quarter

ended June 30, 2006. See Note 15 of Notes to the Consolidated Financial Statements for a discussion of the

proceeding regarding the purported default.

Derivative Instruments and Hedging Activities

To more closely align interest expense with interest income received on the Company’s cash equivalent and

investment balances, the Company has entered into interest rate swap agreements to convert the majority of its

interest rate exposure from fixed rates to floating rates. The interest rate swap agreements have aggregate

notional amounts of $5.1 billion and $5.6 billion at December 31, 2008 and December 31, 2007, respectively.

The floating rates are benchmarked to LIBOR. The swaps are designated as fair value hedges of the fixed-rate

debt under the short-cut method of FAS 133, and are reported at fair market value in the Company’s

Consolidated Balance Sheets with the carrying value of the debt adjusted by an offsetting amount, with no

changes in market value recognized through the Company’s Consolidated Statements of Operations.

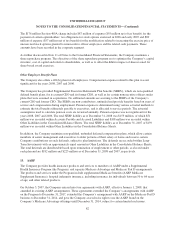

In January 2009 the Company terminated $4.9 billion notional of interest rate swap contracts with financial

institutions to lock-in the benefit of current low market interest rates. The cumulative adjustment to the carrying

value of the Company’s debt was $513 million and will be amortized as a reduction to interest expense over the

remaining life of the related debt, resulting in a weighted average interest rate of 3.3%.

76