United Healthcare 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

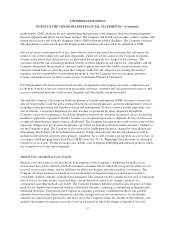

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Company had an aggregate $2.0 billion reinsurance receivable, of which $154 million was recorded in Other

Current Receivables and $1.9 billion was recorded in Other Assets in the Consolidated Balance Sheets. As of

December 31, 2007, the Company had an aggregate $2.0 billion reinsurance receivable, of which $167 million

was recorded in Other Current Receivables and $1.8 billion was recorded in Other Assets in the Consolidated

Balance Sheets. The Company evaluates the financial condition of the reinsurer and only records the reinsurance

receivable to the extent of probable recovery.

Policy Acquisition Costs

The Company’s commercial health insurance contracts typically have a one-year term and may be cancelled by

the customer with at least 31 days notice. Costs related to the acquisition and renewal of commercial customer

contracts are charged to expense as incurred.

Share-Based Compensation

The Company accounts for share-based compensation in accordance with Statement of Financial Accounting

Standards (FAS) No. 123 (revised 2004), “Share-Based Payment” (FAS 123R) under the modified retrospective

method of adoption. Under the fair value recognition provisions of this statement, share-based compensation cost

is measured at the grant date based on the fair value of the award and is recognized as expense over the period in

which the share-based compensation vests.

Net Earnings Per Common Share

The Company computes basic net earnings per common share by dividing net earnings by the weighted-average

number of common shares outstanding during the period. The Company determines diluted net earnings per

common share using the weighted-average number of common shares outstanding during the period, adjusted for

potentially dilutive shares associated with the exercise of common stock options, stock-settled stock appreciation

rights (SARs) and the conversion of convertible subordinated debentures.

Derivative Financial Instruments

As part of the Company’s risk management strategy, the Company enters into interest rate swap agreements with

financial institutions to manage the impact of market interest rates on interest expense. The differential between

the fixed rates received and the variable rates paid is accrued and recognized over the life of the agreements as an

adjustment to interest expense in the Consolidated Statements of Operations. The Company’s swap agreements

converted a majority of its interest expense from fixed to variable rates to better offset the impact of market rates

on its variable rate cash equivalent investments and are accounted for under the short-cut method as fair value

hedges. Additional information on the Company’s derivative financial instruments is included in Note 9 of Notes

to the Consolidated Financial Statements.

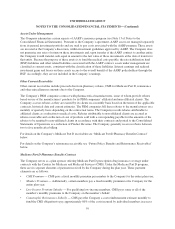

Recent Accounting Standards

Recently Adopted Accounting Standards. In February 2007, the FASB issued FAS No. 159, “The Fair Value

Option for Financial Assets and Financial Liabilities — Including an amendment of FASB Statement No. 115”

(FAS 159). FAS 159 expands the use of fair value accounting but does not affect existing standards that require

assets or liabilities to be carried at fair value. Under FAS 159, a company may elect to use fair value to measure

various assets and liabilities including accounts receivable, available-for-sale and held-to-maturity securities,

equity method investments, accounts payable, guarantees and issued debt. The fair value election is irrevocable

63