United Healthcare 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

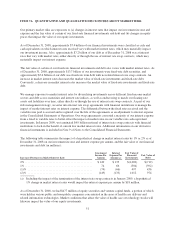

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Our primary market risks are exposures to (a) changes in interest rates that impact our investment income and

expense and the fair value of certain of our fixed-rate financial investments and debt and (b) changes in equity

prices that impact the value of our equity investments.

As of December 31, 2008, approximately $7.4 billion of our financial investments were classified as cash and

cash equivalents on which interest rates received vary with market interest rates, which may materially impact

our investment income. Also, approximately $7.2 billion of our debt as of December 31, 2008 was at interest

rates that vary with market rates, either directly or through the use of interest rate swap contracts, which may

materially impact our interest expense.

The fair value of certain of our fixed-rate financial investments and debt also varies with market interest rates. As

of December 31, 2008, approximately $13.7 billion of our investments were fixed-rate debt securities, and

approximately $5.6 billion of our debt was fixed-rate term debt with no related interest rate swap contracts. An

increase in market interest rates decreases the market value of fixed-rate investments and fixed-rate debt.

Conversely, a decrease in market interest rates increases the market value of fixed-rate investments and fixed-rate

debt.

We manage exposure to market interest rates by diversifying investments across different fixed income market

sectors and debt across maturities and interest rate indices, as well as endeavoring to match our floating rate

assets and liabilities over time, either directly or through the use of interest rate swap contracts. As part of our

risk management strategy, we enter into interest rate swap agreements with financial institutions to manage the

impact of market interest rates on interest expense. The differential between the fixed rates received and the

variable rates paid is accrued and recognized over the life of the agreements as an adjustment to interest expense

in the Consolidated Statements of Operations. Our swap agreements converted a majority of our interest expense

from a fixed to variable rates to better offset the impact of market rates on our variable rate cash equivalent

investments. In January 2009, we terminated $4.9 billion notional of interest rate swap contracts with financial

institutions to lock-in the benefit of current low market interest rates. Additional information on our derivative

financial instruments is included in Note 9 of Notes to the Consolidated Financial Statements.

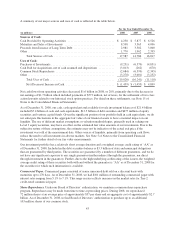

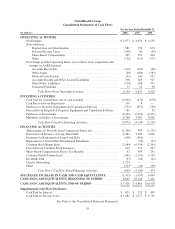

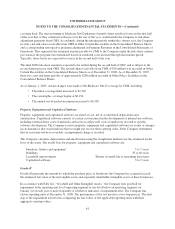

The following table summarizes the impact of a hypothetical change in market interest rates by 1% or 2% as of

December 31, 2008 on our investment income and interest expense per annum, and the fair value of our financial

investments and debt (in millions):

Increase (Decrease) in Market Interest Rate

Investment

Income Per

Annum

Interest

Expense Per

Annum (a)

Fair Value of

Financial

Investments

Fair Value of

Debt

2%.............................................. $149 $133 $(1,009) $(719)

1%.............................................. 74 66 (504) (392)

(1)% ............................................ (74) (66) 497 436

(2)% ............................................ (149) (133) 1,012 974

(a) Including the impact of the termination of the interest rate swap contracts in January 2009, a hypothetical

1% change in market interest rates would impact the interest expense per annum by $18 million.

As of December 31, 2008, we had $477 million of equity securities and venture capital funds, a portion of which

were held in various public and non-public companies concentrated in the areas of health care delivery and

related information technologies. Market conditions that affect the value of health care or technology stocks will

likewise impact the value of our equity investments.

51