United Healthcare 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The weighted-average grant date fair value of restricted shares granted for 2008, 2007 and 2006 was $34 per

share, $51 per share and $56 per share, respectively. The total fair value of restricted shares vested during 2008,

2007 and 2006 was $17 million, $35 million and $35 million, respectively.

Employee Stock Purchase Plan

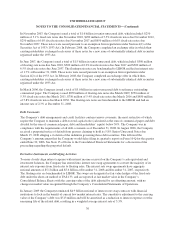

The Company’s Employee Stock Purchase Plan (ESPP) is intended to enhance employee commitment to the

goals of the Company, by providing a means of achieving stock ownership at advantageous terms to eligible

employees of the Company. Eligible employees are allowed to purchase the Company’s stock at a discounted

price, which is 85% of the lower market price of the Company’s common stock at the beginning or at the end of

the six-month purchase period. During 2008, 2007 and 2006, 2.9 million shares, 1.9 million shares and

1.9 million shares of common stock, respectively, were purchased under the ESPP. The compensation expense is

included in the compensation expense amounts recognized and discussed below. At December 31, 2008, there

were 13.1 million shares of common stock available for issuance under the ESPP.

Share-Based Compensation Recognition

The Company recognizes compensation expense for share-based awards, including stock options, SARs and

restricted shares, on a straight-line basis over the related service period (generally the vesting period) of the

award, or to an employee’s eligible retirement date under the award agreement, if earlier. For 2008, 2007 and

2006 the Company recognized compensation expense related to its share-based compensation plans of $305

million ($202 million net of tax effects), $505 million ($325 million net of tax effects) and $404 million ($259

million net of tax effects), respectively. Share-based compensation expense is recognized within Operating Costs

in the Company’s Consolidated Statements of Operations. Share compensation expense for 2006 included $31

million associated with the cash settlement of stock options expiring or forfeiting during the period. At

December 31, 2008, there was $518 million of total unrecognized compensation cost related to share awards that

is expected to be recognized over a weighted-average period of approximately 1.5 years. For 2008, 2007 and

2006 the income tax benefit realized from share-based award exercises was $106 million, $399 million and $287

million, respectively.

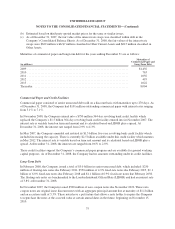

Included in the share-based compensation expense for the year ended December 31, 2007 is $176 million ($112

million net of tax benefit) of expenses recorded in the first quarter of 2007 related to application of deferred

compensation rules under Section 409A of the Internal Revenue Code (Section 409A) to the Company’s

historical stock option practices. As part of its review of the Company’s historical stock option practices, the

Company determined that certain stock options granted to individuals who were nonexecutive officer employees

at the time of grant were granted with an exercise price that was lower than the closing price of the Company’s

common stock on the applicable accounting measurement date, subjecting these individuals to additional tax

under Section 409A. The Company elected to pay these individuals for the additional tax costs relating to such

stock options exercised in 2006 and early 2007. For any outstanding stock options subject to additional tax under

Section 409A that were granted to nonexecutive officer employees, the Company increased the exercise price

and committed to make cash payments to these optionholders for their vested options based on the difference

between the original stock option price and the revised increased stock option price. The payments will be made

on a quarterly basis upon vesting of the applicable awards. The first payment of $110 million was made to

optionholders in January 2008 for options that vested through December 31, 2007. Payments of $6 million were

made to optionholders in 2008 for options that vested through October 31, 2008. Payments of $20 million were

made to optionholders in January 2009 for options that vested through December 31, 2008. Aggregate future

payments will be $7 million, assuming all applicable options vest during 2009. If the modified stock options are

subsequently exercised, the Company will recover these cash payments at that time from exercise proceeds at the

revised increased stock option exercise prices.

81