United Healthcare 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

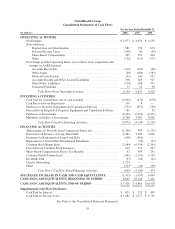

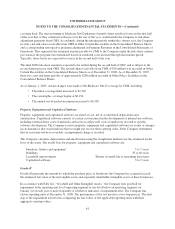

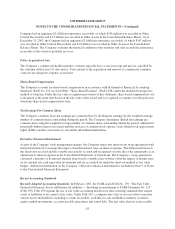

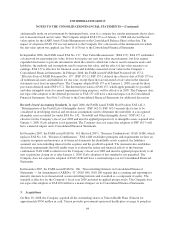

UnitedHealth Group

Consolidated Statements of Cash Flows

For the Year Ended December 31,

(in millions) 2008 2007 2006

OPERATING ACTIVITIES

Net Earnings ................................................... $2,977 $ 4,654 $ 4,159

Noncash Items:

Depreciation and Amortization ................................. 981 796 670

Deferred Income Taxes ....................................... (166) 86 (96)

Share-Based Compensation ................................... 305 505 404

Other ..................................................... (122) (213) (171)

Net Change in Other Operating Items, net of effects from acquisitions and

changes in AARP balances:

Accounts Receivable ......................................... (219) (194) (28)

Other Assets ............................................... (48) (386) (383)

Medical Costs Payable ....................................... (41) 149 597

Accounts Payable and Other Accrued Liabilities ................... 708 269 947

Other Policy Liabilities ....................................... (170) 188 337

Unearned Premiums ......................................... 33 23 90

Cash Flows From Operating Activities ...................... 4,238 5,877 6,526

INVESTING ACTIVITIES

Cash Paid for Acquisitions, net of cash assumed ....................... (4,012) (270) (670)

Cash Received from Disposition ................................... 199 8 —

Purchases of Property, Equipment and Capitalized Software ............. (791) (871) (728)

Proceeds from Disposal of Property, Equipment and Capitalized Software . . 185 — 52

Purchases of Investments ......................................... (9,251) (6,379) (4,851)

Maturities and Sales of Investments ................................. 8,598 3,365 4,096

Cash Flows Used For Investing Activities .................... (5,072) (4,147) (2,101)

FINANCING ACTIVITIES

(Repayments of) Proceeds from Commercial Paper, net ................. (1,346) 947 (2,332)

Proceeds from Issuance of Long-Term Debt .......................... 2,981 3,582 3,000

Payments for Retirement of Long-Term Debt ......................... (500) (950) —

Repayments of Convertible Subordinated Debentures ................... — (10) (91)

Common Stock Repurchases ...................................... (2,684) (6,599) (2,345)

Proceeds from Common Stock Issuances ............................. 299 712 397

Share-Based Compensation Excess Tax Benefits ...................... 62 303 241

Customer Funds Administered ..................................... (461) (1,110) 1,705

Dividends Paid ................................................. (37) (40) (41)

Checks Outstanding ............................................. 1,224 — —

Other ......................................................... (143) (20) (60)

Cash Flows (Used For) From Financing Activities ............. (605) (3,185) 474

(DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS ........ (1,439) (1,455) 4,899

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD .......... 8,865 10,320 5,421

CASH AND CASH EQUIVALENTS, END OF PERIOD ................. $7,426 $ 8,865 $10,320

Supplemental Cash Flow Disclosures

Cash Paid for Interest ............................................ $ 621 $ 553 $ 409

Cash Paid for Income Taxes ....................................... $1,882 $ 2,277 $ 1,729

See Notes to the Consolidated Financial Statements.

55