United Healthcare 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

coverage limit. The uneven timing of Medicare Part D pharmacy benefit claims results in losses in the first half

of the year that, if they continued at that pace for the rest of the year, would entitle the Company to risk-share

adjustment payments from CMS. Accordingly, during the interim periods within the contract year, the Company

records a net risk-share receivable from CMS in Other Current Receivables in the Consolidated Balance Sheets

and a corresponding retrospective premium adjustment in Premium Revenues in the Consolidated Statements of

Operations. This represents the estimated amount payable by CMS to the Company under the risk-share contract

provisions if the program were terminated based on estimated costs incurred through that interim period.

Typically, those losses are expected to reverse in the second half of the year.

The final 2008 risk-share amount is expected to be settled during the second half of 2009, and is subject to the

reconciliation process with CMS. The net risk-share receivable from CMS of $19 million was recorded in Other

Current Receivables in the Consolidated Balance Sheets as of December 31, 2008. As of December 31, 2007,

there was a net risk-share payable of approximately $280 million recorded in Other Policy Liabilities in the

Consolidated Balance Sheets.

As of January 1, 2009, certain changes were made to the Medicare Part D coverage by CMS, including:

• The initial coverage limit increased to $2,700.

• The catastrophic coverage begins at $6,154.

• The annual out-of-pocket maximum increased to $4,350.

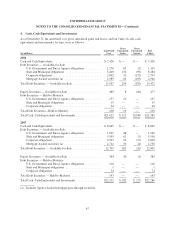

Property, Equipment and Capitalized Software

Property, equipment and capitalized software are stated at cost, net of accumulated depreciation and

amortization. Capitalized software consists of certain costs incurred in the development of internal-use software,

including external direct costs of materials and services and payroll costs of employees devoted to specific

software development. The Company reviews property, equipment and capitalized software for events or changes

in circumstances that would indicate that we might not recover their carrying value. If the Company determines

that an asset may not be recoverable, an impairment charge is recorded.

The Company calculates depreciation and amortization using the straight-line method over the estimated useful

lives of the assets. The useful lives for property, equipment and capitalized software are:

Furniture, fixtures and equipment 3 to 7 years

Buildings 35 to 40 years

Leasehold improvements Shorter of useful life or remaining lease term

Capitalized software 3 to 9 years

Goodwill

Goodwill represents the amount by which the purchase price of businesses the Company has acquired exceeds

the estimated fair value of the net tangible assets and separately identifiable intangible assets of these businesses.

In accordance with FAS 142, “Goodwill and Other Intangible Assets,” the Company tests goodwill for

impairment at the reporting unit level (operating segment or one level below an operating segment) on

January 1st of each year or more frequently if it believes indicators of impairment exist. The Company has

eleven reporting units at December 31, 2008. The performance of the test involves a two-step process. The first

step of the impairment test involves comparing the fair values of the applicable reporting units with their

aggregate carrying values,

61