Under Armour 2012 Annual Report Download - page 66

Download and view the complete annual report

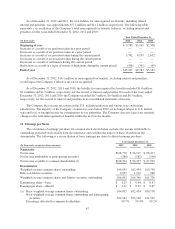

Please find page 66 of the 2012 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exercise price of the option. The stock-based compensation expense for these awards was fully amortized in

2010. Had the Company elected to account for all stock-based compensation awards at fair value, the impact to

net income and earnings per share for the year ended December 31, 2010 would not have been material to its

consolidated financial position or results of operations.

The Company issues new shares of Class A Common Stock upon exercise of stock options, grant of

restricted stock or share unit conversion. Refer to Note 12 for further details on stock-based compensation.

Management Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from these estimates.

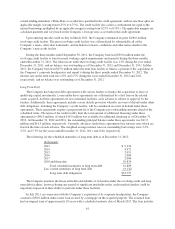

Fair Value of Financial Instruments

The carrying amounts shown for the Company’s cash and cash equivalents, accounts receivable and

accounts payable approximate fair value because of the short term maturity of those instruments. The fair value

of the long term debt approximates its carrying value based on the variable nature of interest rates and current

market rates available to the Company. The fair value of foreign currency forward contracts is based on the net

difference between the U.S. dollars to be received or paid at the contracts’ settlement date and the U.S. dollar

value of the foreign currency to be sold or purchased at the current forward exchange rate. The fair value of the

interest rate swap contract is based on the net difference between the fixed interest to be paid and variable

interest to be received over the term of the contract based on current market rates.

Recently Issued Accounting Standards

In February 2013, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards

Update which requires companies to present either in a single note or parenthetically on the face of the financial

statements, the effect of significant amounts reclassified from each component of accumulated other comprehensive

income based on its source and the income statement line items affected by the reclassification. This guidance is

effective for annual and interim reporting periods beginning after December 15, 2012. The Company believes the

adoption of this pronouncement will not have a material impact on its consolidated financial statements.

Recently Adopted Accounting Standards

In July 2012, the FASB issued an Accounting Standards Update which allows companies to assess

qualitative factors to determine the likelihood of indefinite-lived intangible asset impairment and whether it is

necessary to perform the quantitative impairment test currently required. This guidance is effective for annual

and interim impairment tests performed for fiscal years beginning after September 15, 2012, with early adoption

permitted. The early adoption of this pronouncement did not have an impact on the Company’s consolidated

financial statements.

3. Acquisitions

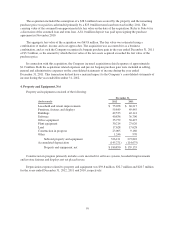

In July 2011, the Company acquired approximately 400.0 thousand square feet of office space comprising

its corporate headquarters for $60.5 million. The acquisition included land, buildings, tenant improvements and

third party lease-related intangible assets. As of December 31, 2012, 141.4 thousand square feet of the

400.0 thousand square feet acquired was leased to third party tenants with remaining lease terms ranging from 1

month to 13.5 years. The Company intends to occupy additional space as it becomes available.

58