Under Armour 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

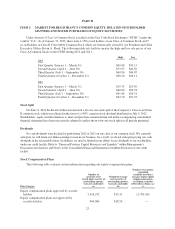

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

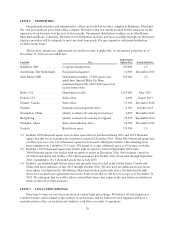

Under Armour’s Class A Common Stock is traded on the New York Stock Exchange (“NYSE”) under the

symbol “UA”. As of January 31, 2013, there were 1,158 record holders of our Class A Common Stock and 5

record holders of Class B Convertible Common Stock which are beneficially owned by our President and Chief

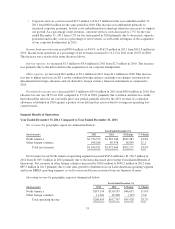

Executive Officer Kevin A. Plank. The following table sets forth by quarter the high and low sale prices of our

Class A Common Stock on the NYSE during 2012 and 2011.

High Low

2012

First Quarter (January 1 – March 31) $49.68 $35.13

Second Quarter (April 1 – June 30) $53.93 $44.30

Third Quarter (July 1 – September 30) $60.96 $44.07

Fourth Quarter (October 1 – December 31) $60.20 $46.11

2011

First Quarter (January 1 – March 31) $35.35 $25.89

Second Quarter (April 1 – June 30) $40.00 $30.78

Third Quarter (July 1 – September 30) $41.48 $26.31

Fourth Quarter (October 1 – December 31) $43.70 $31.25

Stock Split

On June 11, 2012 the Board of Directors declared a two-for-one stock split of the Company’s Class A and Class

B common stock, which was effected in the form of a 100% common stock dividend distributed on July 9, 2012.

Stockholders’ equity and all references to share and per share amounts herein and in the accompanying consolidated

financial statements have been retroactively adjusted to reflect the two-for-one stock split for all periods presented.

Dividends

No cash dividends were declared or paid during 2012 or 2011 on any class of our common stock. We currently

anticipate we will retain any future earnings for use in our business. As a result, we do not anticipate paying any cash

dividends in the foreseeable future. In addition, we may be limited in our ability to pay dividends to our stockholders

under our credit facility. Refer to “Financial Position, Capital Resources and Liquidity” within Management’s

Discussion and Analysis and Note 6 to the Consolidated Financial Statements for further discussion of our credit

facility.

Stock Compensation Plans

The following table contains certain information regarding our equity compensation plans.

Plan Category

Number of

securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

Number of securities

remaining

available for future

issuance under equity

compensation plans

(excluding securities

reflected in column (a))

(c)

Equity compensation plans approved by security

holders 5,418,292 $15.31 11,701,814

Equity compensation plans not approved by

security holders 960,000 $18.50 —

23