Under Armour 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tinue to build upon that momentum in 2013.

Some of that momentum will be evident in

Running footwear, where we built upon some

of the early success of our $120 UA Charge RC

product and Micro G cushioning technology

to unveil UA Spine last July. UA Spine is our

unique stance on melding lightweight and sta-

bility, and the platform will move well beyond

running in 2013.

Great product requires great distribution,

and we continue to work with our partners like

Dick’s Sporting Goods, The Sports Authority,

and Academy to elevate our Brand. Ongoing

investments such as our All-American and

Blue Chip shop-in-shops with Dick’s Sporting

Goods are providing a more comprehensive as-

sortment to our consumers. At the same time,

we continue to look for new ways to reach con-

sumers, especially in channels that are more

relevant to certain product categories like

Women’s and Youth. To that end, we entered

more than 500 new department store doors

in 2012, including Macy’s, Dillards, Belk and

Lord & Taylor, and are positioned to broaden

this reach going forward.

Our conversation around distribution

would not be complete without our Direct-to-

Consumer channel. Direct-to-Consumer net

revenues grew 34 percent in 2012 to over a half

of a billion dollars, or nearly the size of our en-

tire business in 2007. The channel represented

29 percent of total net revenues for the year, up

from 27 percent in 2011 and 23 percent in 2010.

The bulk of this business is driven by our Fac-

tory House outlet stores, which continue to help

us better manage our excess inventory while

reaching out and providing value to our con-

sumers. We expanded this store base in the U.S.

from 80 stores in 2011 to 101 in 2012.

Beyond outlets, we opened the next gen-

eration of UA Specialty with our Harbor East

store in downtown Baltimore in February

2013. Delivering an unrivaled store experi-

ence through specialization, localization, and

innovation, the store provides an important

learning lab that we will continue to refine

and test with additional stores in the future in

strategic locations.

Rounding out Direct-to-Consumer, Ecom-

merce will continue to be a growth vehicle for

the company as we drive enhanced merchan-

dising and storytelling, including a clearer

connection with some of our larger branding

initiatives planned in 2013.

While all these initiatives continue to drive

our business at home, we are mindful that the

opportunities abroad are bigger. Our interna-

tional business represented only 6% of net rev-

enues in 2012, and we continue to believe that

the strength in our core U.S. business affords

us the opportunity and patience to make the

right decisions in Europe, Latin America, and

Asia. We are able to take a different, broader

approach to how we enter these markets. Our

grassroots efforts help us build the Brand by

being intensely focused on sport authenticity

in local markets. We are able to balance this

approach with larger brand-building initia-

tives such as the July 2012 introduction of

our kit for Tottenham Hotspur of the English

Premier League, reaching over 20 million fans

globally. Finally, in the age where we are all

connected like never before through technol-

ogy, we have the ability to change the tradi-

tional approach to reaching consumers in new

markets through digital means like Ecommerce

and social media.

With all of our focus on building great prod-

uct for athletes, no

element of our busi-

ness is more criti-

cal to our success

than the continued

development of our

team. As we build

the organizational

structure in Balti-

more and around

the world, we will

consistently sup-

plement this great

leadership to help ensure our progress as a lead-

ing global athletic brand. In 2012, we added

new leadership within International, Supply

Chain, Women’s, and Human Resources. Our

success in 2012 is a direct result of the team

we have and continue to build in Baltimore and

around the world.

Expect to see more of us in 2013 and be-

yond. Expect a louder, more focused, more

disruptive voice. Expect more innovation and

product that redefines how an athlete performs.

As we prepare for 2013 and beyond, we will re-

main humble in the success we have achieved

and hungry to press on to new opportunities.

Kevin A. Plank

Chairman of the Board of Directors &

Chief Executive Officer

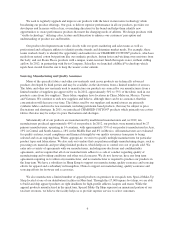

$208,696

+28%

$162,767

+45%

$112,355

+32%

$85,273

+11%

$76,925

-11 %

WE HAVE DELIVERED 11 CONSECUTIVE

QUARTERS OF 20%+ GROWTH, WHICH

HAS ENABLED US TO ADD NEARLY $1

BILLION IN NET REVENUES OVER THE

PAST THREE YEARS.

INCOME FROM OPERATIONS

IN THOUSANDS; YEAR 2008–2012

2008 2009 2010 2011 2012

5-YEAR COMPOUND ANNUAL GROWTH RATE* 19.3%

* Based on fiscal year 2007 income from operations of $86,265

NET REVENUES BY PRODUCT

CATEGORY YEAR 2012

APPAREL 75.6%

FOOTWEAR 13.0%

ACCESSORIES 9.0%

LICENSING REVENUES 2.4%

GAME-CHANGING PRODUCT LIKE

THE UA HIGHLIGHT CLEAT HAS

PROVIDED MOMENTUM FOR US IN

OTHER FOOTWEAR CATEGORIES.