Under Armour 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.stock units had the full achievement of all operating targets been deemed probable. As a result, if factors change and

we use different assumptions, our stock-based compensation expense could be materially different in the future.

Refer to Note 2 and Note 12 to the Consolidated Financial Statements for a further discussion on stock-based

compensation.

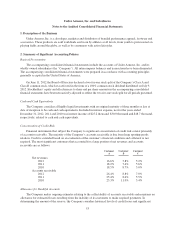

Recently Issued Accounting Standards

In February 2013, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards

Update which requires companies to present either in a single note or parenthetically on the face of the financial

statements, the effect of significant amounts reclassified from each component of accumulated other

comprehensive income based on its source and the income statement line items affected by the reclassification.

This guidance is effective for annual and interim reporting periods beginning after December 15, 2012. We

believe the adoption of this pronouncement will not have a material impact on our consolidated financial

statements.

Recently Adopted Accounting Standards

In July 2012, the FASB issued an Accounting Standards Update which allows companies to assess

qualitative factors to determine the likelihood of indefinite-lived intangible asset impairment and whether it is

necessary to perform the quantitative impairment test currently required. This guidance is effective for annual

and interim impairment tests performed for fiscal years beginning after September 15, 2012, with early adoption

permitted. The early adoption of this pronouncement did not have an impact on our consolidated financial

statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

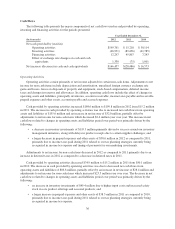

Foreign Currency Risk

We currently generate a small amount of our consolidated net revenues in Canada and Europe. The

reporting currency for our consolidated financial statements is the U.S. dollar. To date, net revenues generated

outside of the United States have not been significant. However, as our net revenues generated outside of the

United States increase, our results of operations could be adversely impacted by changes in foreign currency

exchange rates. For example, if we recognize foreign revenues in local foreign currencies (as we currently do in

Canada and Europe) and if the U.S. dollar strengthens, it could have a negative impact on our foreign revenues

upon translation of those results into the U.S. dollar upon consolidation of our financial statements. In addition,

we are exposed to gains and losses resulting from fluctuations in foreign currency exchange rates on transactions

generated by our foreign subsidiaries in currencies other than their local currencies. These gains and losses are

primarily driven by intercompany transactions. These exposures are included in other expense, net on the

consolidated statements of income.

From time to time, we may elect to enter into foreign currency forward contracts to reduce the risk

associated with foreign currency exchange rate fluctuations on intercompany transactions and projected

inventory purchases for our European and Canadian subsidiaries. In addition, we may elect to enter into foreign

currency forward contracts to reduce the risk associated with foreign currency exchange rate fluctuations on

Pound Sterling denominated balance sheet items. We do not enter into derivative financial instruments for

speculative or trading purposes.

Based on the foreign currency forward contracts outstanding as of December 31, 2012, we receive U.S.

Dollars in exchange for Canadian Dollars at a weighted average contractual forward foreign currency exchange

rate of 0.99 CAD per $1.00, U.S. Dollars in exchange for Euros at a weighted average contractual foreign

currency exchange rate of €0.76 per $1.00 and Euros in exchange for Pounds Sterling at a weighted average

contractual foreign currency exchange rate of £0.81 per €1.00. As of December 31, 2012, the notional value of

43