Under Armour 2012 Annual Report Download - page 23

Download and view the complete annual report

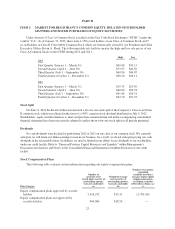

Please find page 23 of the 2012 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• sell certain assets;

• make certain investments;

• guarantee certain obligations of third parties;

• undergo a merger or consolidation; and

• materially change our line of business.

Our revolving credit facility also provides the lenders with the ability to reduce the borrowing base, even if

we are in compliance with all conditions of the revolving credit facility, upon a material adverse change to our

business, properties, assets, financial condition or results of operations. In addition, we must maintain a certain

leverage ratio and interest coverage ratio as defined in the credit agreement. Failure to comply with these

operating or financial covenants could result from, among other things, changes in our results of operations or

general economic conditions. These covenants may restrict our ability to engage in transactions that would

otherwise be in our best interests. Failure to comply with any of the covenants under the credit agreement could

result in a default. In addition, the credit agreement includes a cross default provision whereby an event of

default under certain other debt obligations will be considered an event of default under the credit agreement. A

default under the credit agreement could cause the lenders to accelerate the timing of payments and exercise their

lien on essentially all of our assets, which would have a material adverse effect on our business, operations,

financial condition and liquidity. In addition, because borrowings under the revolving credit facility bear interest

at variable interest rates, which we do not anticipate hedging against, increases in interest rates would increase

our cost of borrowing, resulting in a decline in our net income and cash flow. There were no amounts outstanding

under our revolving credit facility as of December 31, 2012.

We may need to raise additional capital required to grow our business, and we may not be able to raise

capital on terms acceptable to us or at all.

Growing and operating our business will require significant cash outlays and capital expenditures and

commitments. If cash on hand and cash generated from operations are not sufficient to meet our cash

requirements, we will need to seek additional capital, potentially through debt or equity financing, to fund our

growth. We may not be able to raise needed cash on terms acceptable to us or at all. Financing may be on terms

that are dilutive or potentially dilutive to our stockholders, and the prices at which new investors would be

willing to purchase our securities may be lower than the current price per share of our common stock. The

holders of new securities may also have rights, preferences or privileges which are senior to those of existing

holders of common stock. If new sources of financing are required, but are insufficient or unavailable, we will be

required to modify our growth and operating plans based on available funding, if any, which would harm our

ability to grow our business.

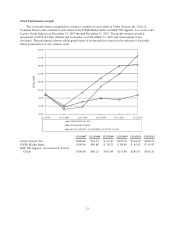

Our operating results are subject to seasonal and quarterly variations in our net revenues and net income,

which could adversely affect the price of our Class A Common Stock.

We have experienced, and expect to continue to experience, seasonal and quarterly variations in our net

revenues and net income. These variations are primarily related to increased sales of our products during the fall

season, reflecting our historical strength in fall sports, and the seasonality of sales of our higher priced

COLDGEAR®line. The majority of our net revenues were generated during the last two quarters in each of

2012, 2011 and 2010, respectively.

Our quarterly results of operations may also fluctuate significantly as a result of a variety of other factors,

including, among other things, the timing and introduction of advertising for new products and changes in our

product mix. Variations in weather conditions may also have an adverse effect on our quarterly results of

operations. For example, warmer than normal weather conditions throughout the fall or winter may reduce sales

of our COLDGEAR®line, leaving us with excess inventory and operating results below our expectations.

15