Sharp 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 Sharp Annual Report 2008

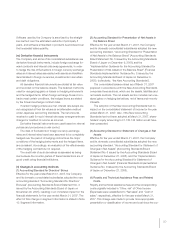

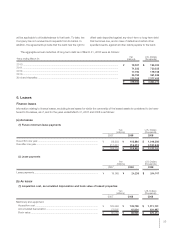

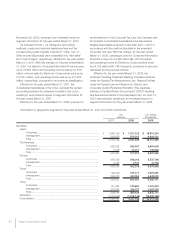

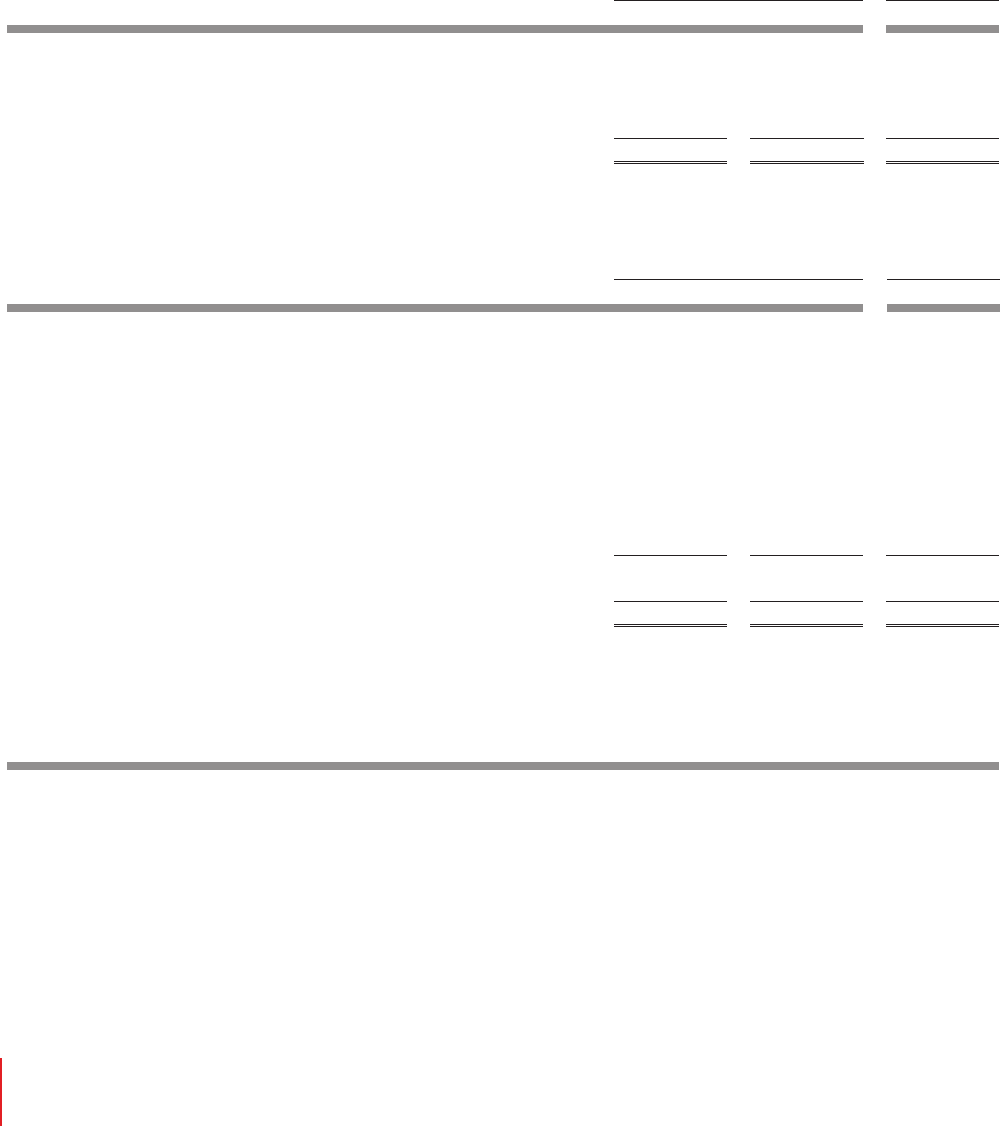

5. Short-term Borrowings and Long-term Debt

The weighted average interest rates of short-term borrowings

as of March 31, 2007 and 2008 were 3.4% and 1.9%,

respectively. The Company and its consolidated subsidiaries

have had no difficulty renewing such loans when they have

considered such renewal advisable.

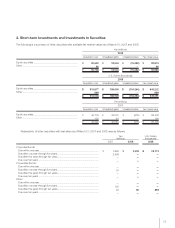

Bank loans........................................................................................................

Bankers’ acceptances payable .........................................................................

Commercial paper.............................................................................................

Current portion of long-term debt......................................................................

$ 1,213,525

101

1,597,657

464,757

$ 3,276,040

¥ 120,139

10

158,168

46,011

¥ 324,328

¥ 118,910

36

22,865

98,927

¥ 240,738

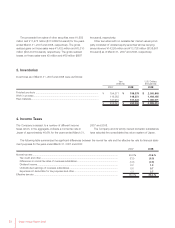

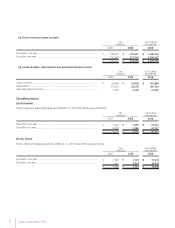

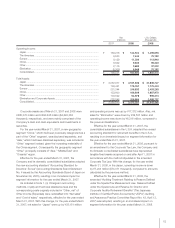

Long-term debt as of March 31, 2007 and 2008 consisted of the following:

0.0%—12.1% unsecured loans principally from banks, due 2007 to 2018........

0.57% unsecured straight bonds, due 2007 .....................................................

0.62% unsecured straight bonds, due 2010 .....................................................

0.97% unsecured straight bonds, due 2012 .....................................................

0.00%

unsecured convertible bonds with subscription rights to shares, due 2013

...

0.32%—1.18% unsecured Euroyen notes issued by

aconsolidated subsidiary, due 2007 to 2013 ..................................................

6.00% mortgage loans for employees housing from a

government-sponsored agency, due 2007 to 2009.........................................

0.48%—1.54% payables under securitized lease receivables, due 2007 to 2014 ..

Less-Current portion included in short-term borrowings....................................

$ 1,217,051

—

303,030

202,020

2,059,859

74,838

—

442,232

4,299,030

(464,757)

$ 3,834,273

¥ 120,488

—

30,000

20,000

203,926

7,409

—

43,781

425,604

(46,011)

¥ 379,593

¥ 106,260

50,000

30,000

20,000

204,643

15,020

1

33,768

459,692

(98,927)

¥ 360,765

200820082007

Yen

(millions) U.S. Dollars

(thousands)

200820082007

Yen

(millions) U.S. Dollars

(thousands)

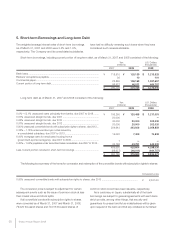

The following is a summary of the terms for conversion and redemption of the convertible bonds with subscription rights to shares:

0.00% unsecured convertible bonds with subscription rights to shares, due 2013 ..................................................... ¥ 2,531.00

Conversion price

Short-term borrowings, including current portion of long-term debt, as of March 31, 2007 and 2008 consisted of the following:

The conversion price is subject to adjustment for certain

subsequent events such as the issue of common stock at less

than market value and stock splits.

If all convertible bonds with subscription rights to shares

were converted as of March 31, 2007 and March 31, 2008,

79,020 thousand shares and 79,018 thousand shares of

common stock would have been issuable, respectively.

As is customary in Japan, substantially all of the bank

borrowings are subject to general agreements with each bank

which provide, among other things, that security and

guarantees for present and future indebtedness will be given

upon request of the bank and that any collateral so furnished