Sharp 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 Sharp Annual Report 2008

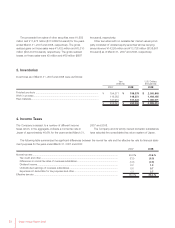

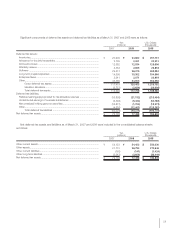

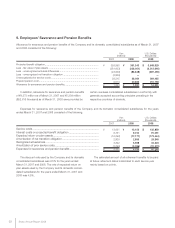

3. Inventories

Finished products ............................................................................................

Work in process ...............................................................................................

Raw materials...................................................................................................

$ 2,005,848

1,498,495

1,085,071

$ 4,589,414

¥ 198,579

148,351

107,422

¥ 454,352

¥ 194,371

119,362

121,910

¥ 435,643

200820082007

Yen

(millions) U.S. Dollars

(thousands)

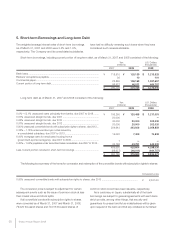

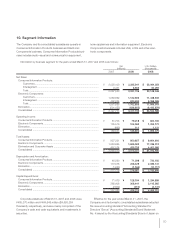

The following table summarizes the significant differences between the normal tax rate and the effective tax rate for financial state-

ment purposes for the years ended March 31, 2007 and 2008:

Normal tax rate .............................................................................................................................

Tax credit and other.................................................................................................................

Differences in normal tax rates of overseas subsidiaries............................................................

Dividend income ......................................................................................................................

Undistributed earnings of overseas subsidiaries .......................................................................

Expenses not deductible for tax purposes and other................................................................

Effective tax rate ...........................................................................................................................

40.6 %

(6.0)

(2.9)

1.3

0.7

2.7

36.4 %

2008

40.6 %

(7.5)

(1.9)

2.2

0.6

1.3

35.3 %

2007

4. Income Taxes

The Company is subject to a number of different income

taxes which, in the aggregate, indicate a normal tax rate in

Japan of approximately 40.6% for the years ended March 31,

2007 and 2008.

T

he Company and its wholly owned domestic subsidiaries

have adopted the consolidated tax return system of Japan.

Inventories as of March 31, 2007 and 2008 were as follows:

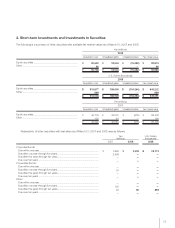

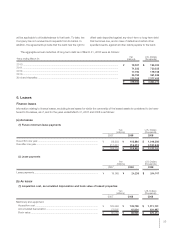

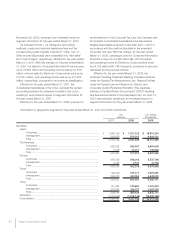

The proceeds from sales of other securities were ¥1,882

million and ¥11,275 million ($113,889 thousand) for the years

ended March 31, 2007 and 2008, respectively. The gross

realized gains on those sales were ¥1,432 million and ¥3,310

million ($33,434 thousand), respectively. The gross realized

losses on those sales were ¥2 million and ¥69 million ($697

thousand), respectively.

Other securities with no available fair market values princi-

pally consisted of unlisted equity securities whose carrying

amounts were ¥14,326 million and ¥13,728 million ($138,667

thousand) as of March 31, 2007 and 2008, respectively.