Sharp 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51 Sharp Annual Report 2008

rent increase in income has arisen business activities carried

out by the Company and its consolidated subsidiaries. With

this change, for the year ended March 31, 2007, net sales

were up by ¥15,614 million, cost of sales was up by ¥4,458

million, and operating income was up by ¥11,156 million,

compared to the previous classification with no impact on

income before income taxes and minority interests for the year

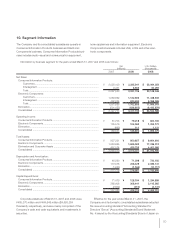

ended March 31, 2007. The effect of this change on segment

information is stated in Note 10. Segment Information.

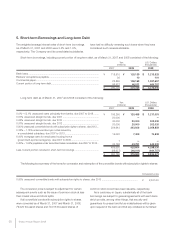

(5) Method of Amortization for Bond Issue Cost

Previously, bond issue cost was fully expensed as incurred.

Effective for the year ended March 31, 2007, however, bond

issue cost was capitalized as deferred assets and amortized

under the straight line method over the redemption period;

This change was made to recognize the effect of financing

cost over the redemption period and realize appropriate peri-

odic accounting of profit and loss. One is because expansion

in scale of bond issue led to increase in bond issue cost.

Other reasons include that the effect of bond issue cost lasts

over redemption period, rather than only when incurred, and

that the amortized cost method is adopted for bonds. Under

this method the difference of ¥5,000 million between the

issue price and face value will be amortized over the redemp-

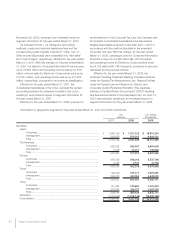

tion period. With this change, for the year ended March 31,

2007, income before income taxes and minority interests was

up by ¥4,865 million, compared to amounts calculated by the

previous method.

(6) Depreciation Methods Used for Amortization for

Tangible Fixed Assets

Effective for the year ended March 31, 2008, pursuant to an

amendment to the Corporate Tax Law, the Company and its

domestic consolidated subsidiaries have depreciated tangible

fixed assets acquired on and after April 1, 2007 in accordance

with the method stipulated in the amended Corporate Tax

Law. As a result, for the year ended March 31, 2008,

operating income and income before income taxes and

minority interests are down by ¥7,234 million ($73,071

thousand) respectively compared to amounts calculated by

the previous method. For the impact that these changes had

on segment information, please refer to Note 10. Segment

Information.

(7) Accounting Method for Reserve for Director and

Corporate Auditor Retirement Benefits

Effective for the year ended March 31, 2008, the amended

“Auditing Treatment Relating to Reserve Defined under the

Special Tax Measurement Law, Reserve Defined under the

Special Law and Reserve for Director and Corporate Auditor

Retirement Benefits” (The Japanese Institute of Certified

Public Accountants (“JICPA”) Auditing and Assurance

Practice Committee Report No. 42, April 13, 2007) was

adopted. As a result, for the year ended March 31, 2008,

operating income and income before income taxes and

minority interests are down by ¥133 million ($1,343 thousand)

and ¥896 million ($9,051 thousand), respectively, compared

to amounts calculated by the previous method.

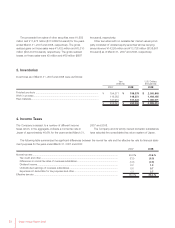

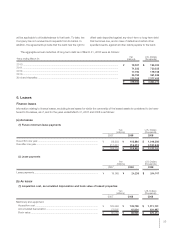

(o) Additional information

(1) Previously, the cost of software embedded in products

was recognized as manufacturing expense at the time of

inspection due to practical convenience. Effective for the year

ended March 31, 2007, however, the cost of software

embedded in products was capitalized as an asset when

inspected and recognized as manufacturing expense when

the products with the embedded software are sold, in accor-

dance with “Accounting Standard for Research and

Development Costs.” This change was made due to the

increase in the amount of software embedded in products,

as a result of an increase in the number of complicated and

multifunctional products in this fiscal year. With this change,

for the year ended March 31, 2007, operating income and

income before income taxes and minority interests were

up by ¥10,455 million respectively, compared to amounts

calculated by the previous method.

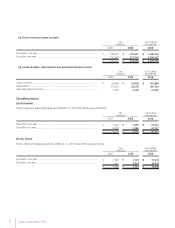

(2) Previously, the Company depreciated tangible fixed assets

acquired on and before March 31, 2007 up to 5% of the

acquisition cost, based on the prior Corporate Tax Law.

Pursuant to an amendment to the Corporate Tax Law, the

Company and its domestic subsidiaries depreciate the

difference between 5% of the acquisition cost and the

memorandum price using the straight line method over 5

years. The straight line depreciation starts from the following

year, when the book value of tangible assets acquired on and

before March 31, 2007 reaches 5% of the acquisition cost.

As a result, for the year ended March 31, 2008, operating

income and income before income taxes and minority

interests are down by ¥7,791 million ($78,697 thousand)

respectively, compared to amounts calculated by the

previous method.