Salesforce.com 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

In addition to the resource sharing with the Foundation, the Company issued the Foundation warrants in August 2002 to purchase 500,000 shares of

common stock. Through January 31, 2007, the Foundation has exercised 375,000 of these warrants. Additionally, the Company has donated subscriptions to

the Company's service to other qualified non-profit organizations. The fair value of these donated subscriptions is in excess of $1.0 million per month. The

Company plans to continue providing free subscriptions to qualified non-profit organizations.

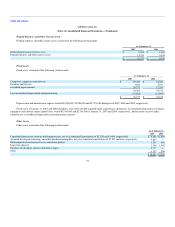

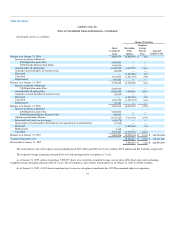

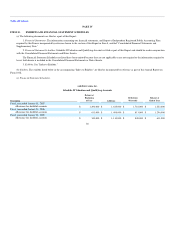

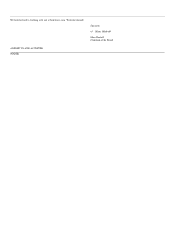

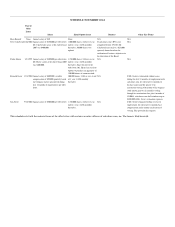

12. Selected Quarterly Financial Data (Unaudited)

Selected summarized quarterly financial information for fiscal 2007 and 2006 is as follows:

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

Fiscal

Year

(in thousands, except per share data)

Fiscal 2007

Revenues $ 104,686 $ 118,137 $ 130,053 $ 144,222 $ 497,098

Gross profit 80,126 89,006 98,693 110,383 378,208

Loss from operations (120) (1,279) (123) (2,076) (3,598)

Net income (loss) (1) (229) (145) 339 516 481

Basic net income (loss) per share (1) 0.00 0.00 0.00 0.00 0.00

Diluted net income (loss) per share (1) 0.00 0.00 0.00 0.00 0.00

Fiscal 2006

Revenues $ 64,177 $ 71,943 $ 82,673 $ 91,064 $ 309,857

Gross profit 52,212 55,706 63,089 69,724 240,731

Lease recovery 285 — — — 285

Income from operations 4,270 4,193 6,387 5,252 20,102

Net income (2) 4,380 5,040 13,097 5,957 28,474

Basic net income per share (2) 0.04 0.05 0.12 0.05 0.27

Diluted net income per share (2) 0.04 0.04 0.11 0.05 0.24

(1) Effective February 1, 2006, the Company adopted the fair value recognition provisions of Statement of Financial Accounting Standards No. 123

(revised 2004), Share-Based Payment, or SFAS 123R, using the modified prospective transition method and therefore has not restated results for prior

periods.

(2) Net income during the third quarter of fiscal 2006 included a $6.8 million income tax benefit associated with the reversal of the Company's deferred tax

valuation allowance.

82