Salesforce.com 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

nonprofit related party. The Company's chairman is the chairman of the Foundation. He, one of the Company's officers and one of the Company's board

members hold three of the Foundation's eight board seats. The warrants are exercisable for one-year terms beginning on August 1, 2003, August 1,

2004, August 1, 2005, and August 1, 2006, respectively. The warrants were issued as a charitable contribution to the Foundation. The warrants were fully

vested on the date of grant without any performance obligations by the Foundation. Through January 31, 2007, the Foundation exercised 375,000 warrants

and as of January 31, 2007, the warrants to purchase an aggregate of 125,000 shares of common stock remain outstanding.

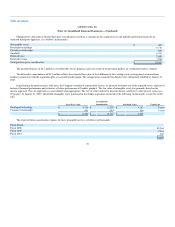

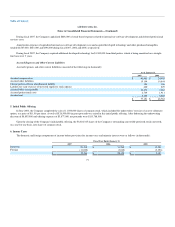

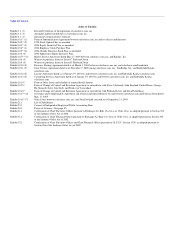

Common Stock

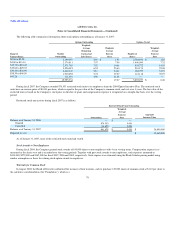

The following shares of common stock are available for future issuance at January 31, 2007:

Options outstanding 15,955,334

Restricted stock units outstanding 841,678

Warrants outstanding 143,000

Stock available for future grant:

1999 Stock Option Plan 923,955

2004 Equity Incentive Plan 3,126,121

2006 Inducement Equity Incentive Plan 149,350

2004 Employee Stock Purchase Plan 1,000,000

2004 Outside Directors Stock Plan 802,500

22,941,938

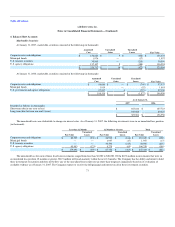

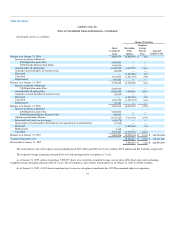

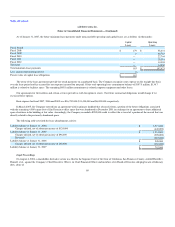

During fiscal 2005, the Board of Directors authorized the issuance of 40,000 shares of common stock to two board members for board services. Of the

40,000 shares, 12,500 shares were distributed pursuant to the terms described in the 2004 Outside Directors Stock Plan. The expense associated with these

share issuances was $646,000 and was expensed immediately at the time of the issuances.

During fiscal 2006, a board member received stock grants for a total of 20,000 shares of common stock for board services pursuant to the terms

described in the 2004 Outside Directors Stock Plan. The expense associated with these share issuances was $389,000 and was expensed immediately at the

time of the issuances.

During fiscal 2007, certain board members received stock grants for a total of 15,000 shares of common stock for board services pursuant to the terms

described in the 2004 Outside Directors Stock Plan. The expense associated with these share issuances was expensed immediately at the time of the issuances.

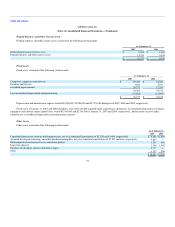

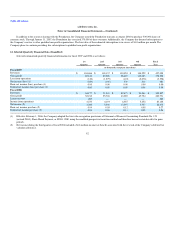

9. Commitments and Contingencies

Letters of Credit

As of January 31, 2007, the Company had a total of $5.9 million in letters of credit outstanding substantially in favor of its landlords for office space in

San Francisco, California, New York, Singapore and Australia. These letters of credit renew annually and mature at various dates through December 2015.

Leases

The Company leases office space and equipment under noncancelable operating and capital leases with various expiration dates.

79