Salesforce.com 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

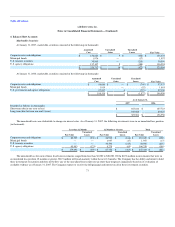

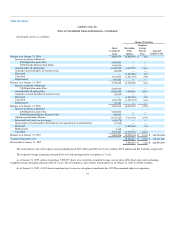

Advertising Expenses

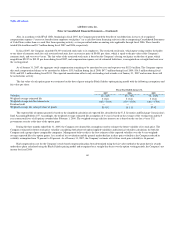

Advertising is expensed as incurred. Advertising expense was $14,733,000, $12,932,000 and $6,908,000 for fiscal 2007, 2006 and 2005, respectively.

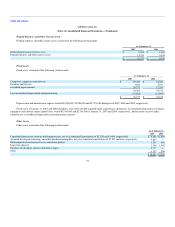

Recent Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes,

("FIN 48"), which clarifies the accounting for uncertainty in income taxes recognized in an enterprise's financial statements and prescribes a recognition

threshold of whether it is more likely than not that a tax position will be sustained upon examination. Measurement of the tax uncertainty occurs if the

recognition threshold has been met. FIN 48 also provides guidance on the recognition, classification, interest and penalties, accounting in interim periods,

disclosure, and transition. FIN 48 will be effective for fiscal years beginning after December 15, 2006. The Company is currently evaluating what impact, if

any, the adoption of FIN 48 will have on its financial position and results of operations.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements ("SFAS No. 157"). The purpose of SFAS No. 157 is to define fair

value, establish a framework for measuring fair value and enhance disclosures about fair value measurements. The measurement and disclosure requirements

are effective beginning in the first quarter of fiscal 2009. The Company is currently assessing whether adoption of SFAS No. 157 will have an impact on its

financial statements.

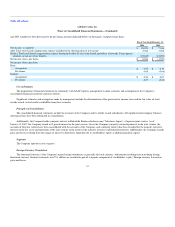

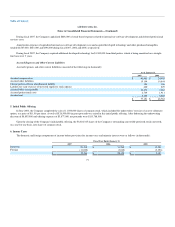

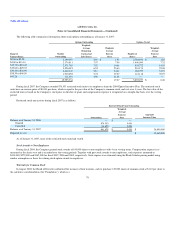

2. Joint Venture

On December 7, 2000, the Company entered into a joint venture agreement with SunBridge, Inc., a Japanese corporation, to establish Salesforce Japan.

In December 2006, in a transaction with SunBridge, Inc., the Company increased its interest in Salesforce Japan from 63 to 65 percent in exchange for a cash

payment of $2.8 million. The Company is accounting for this investment as a step acquisition. The allocation of the investment has not been completed. As of

January 31, 2007, the cost of the additional shares is included in Other Assets in the accompanying Consolidated Balance Sheet.

Provided that the Company owns at least 30 percent of the outstanding voting shares of the joint venture, the Company has the right to appoint three of

the six board members of the joint venture, and together with SunBridge, may appoint a fourth director.

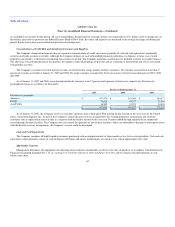

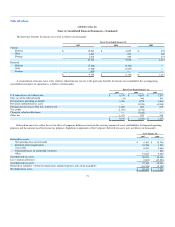

The Board of Directors of the joint venture has authorized option plans to purchase shares in Salesforce Japan. The option plans are in accordance with

the rules and regulations of the Commercial Code of Japan. One of the option plans includes antidilution provisions such that the option holders are allowed

additional options if the joint venture issues additional stock and the exercise price of their options is reduced if the additional stock is issued for an amount

less than such exercise price. These provisions resulted in variable accounting for this plan prior to the adoption of SFAS 123R, as the number of options

awarded is not fixed and no measurement date currently exists.

68