Salesforce.com 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

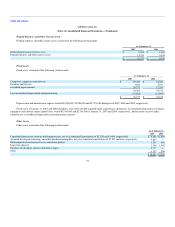

During fiscal 2007, the Company capitalized $808,000 of stock-based expenses related to internal-use software development and deferred professional

services costs.

Amortization expense of capitalized internal-use software development costs and acquired developed technology and other purchased intangibles

totaled $2,587,000, $443,000 and $396,000 during fiscal 2007, 2006 and 2005, respectively.

During fiscal 2007, the Company acquired additional developed technology for $1,300,000 from third parties, which is being amortized on a straight-

line basis over 3 years.

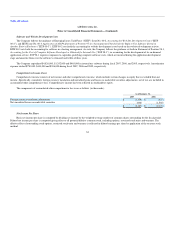

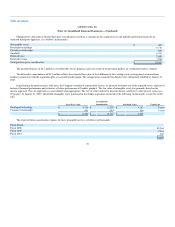

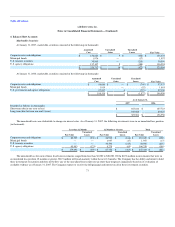

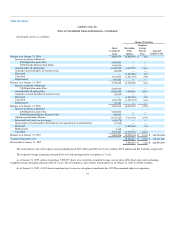

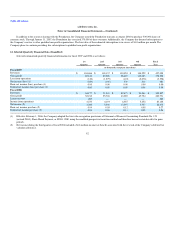

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

As of January 31,

2007 2006

Accrued compensation $ 40,951 $ 24,465

Accrued other liabilities 15,109 10,844

Current portion of lease abandonment liability 186 186

Liability for early exercise of unvested employee stock options 400 229

Accrued other taxes payable 11,276 7,463

Accrued professional costs 2,749 1,911

Accrued rent 6,480 3,684

$ 77,151 $ 48,782

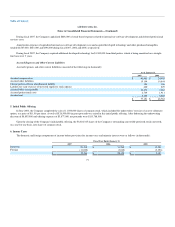

5. Initial Public Offering

In June 2004, the Company completed the sale of 11,500,000 shares of common stock, which included the underwriters' exercise of an over-allotment

option, at a price of $11.00 per share. A total of $126,500,000 in gross proceeds was raised in this initial public offering. After deducting the underwriting

discount of $8,855,000 and offering expenses of $3,877,000, net proceeds were $113,768,000.

Upon the closing of the Company's initial public offering, the 58,024,345 shares of the Company's outstanding convertible preferred stock converted,

on a one-for-one basis, into shares of common stock.

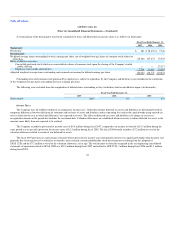

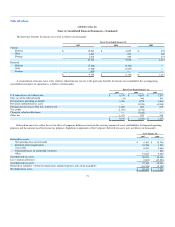

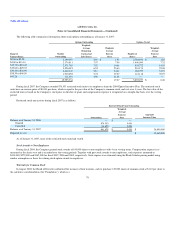

6. Income Taxes

The domestic and foreign components of income before provisions for income taxes and minority interest were as follows (in thousands):

Fiscal Year Ended January 31,

2007 2006 2005

Domestic $ 23,498 $ 31,240 $ 12,509

Foreign (11,002) (3,042) (3,356)

$ 12,496 $ 28,198 $ 9,153

73