Salesforce.com 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

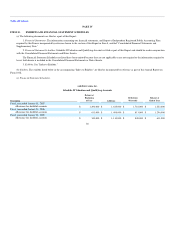

Table of Contents

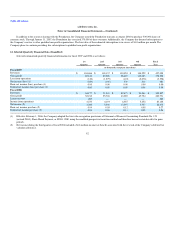

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

control, gross mismanagement, waste of corporate assets and unjust enrichment under state common law. Subsequently, a substantially similar complaint was

filed in the same court based on the same facts and allegations, entitled Johnson v. Benioff, et al. The two actions were consolidated under the caption Borrelli

v. Benioff, Case No. CGC-04-433615 (Cal. Super. Ct., S.F. Cty.). On October 5, 2004, plaintiffs filed a consolidated complaint, and assert that the defendants

breached their fiduciary duties by making, or failing to prevent salesforce.com, inc. and its management from making, statements or omissions that potentially

subject the Company to liability and injury to its reputation. The action seeks damages on behalf of salesforce.com in an unspecified amount, among other

forms of legal and equitable relief. Salesforce.com is named solely as a nominal defendant against which no recovery is sought. The plaintiff shareholders

made no demand upon the Board of Directors prior to filing these actions. On June 15, 2006, defendants filed a demurrer to the consolidated complaint on the

grounds that plaintiffs lack standing to pursue the action because of their failure to make demand upon the Board of Directors. The Court overruled

defendants' demurrer. On October 3, 2006, defendants petitioned the California Court of Appeal for review of the trial court's decision to overrule the

demurrer. The Court of Appeal denied the petition on October 12, 2006. Defendants filed a petition for review of that decision with the California Supreme

Court on October 23, 2006, but the petition for review was denied on January 3, 2007. On December 22, 2006, the trial Court ordered that the lawsuit be

bifurcated into two phases. The first phase is a bench trial to decide the legal issues of (a) whether a duty to disclose internal forecasts in an IPO registration

statement exists in law, (b) if so, under what circumstances this duty exists, and (c) which party bears the burden of proof with respect to the foregoing two

issues. The second phase will address the remaining issues, if any. Accordingly, pursuant to the Court's order, on January 19, 2007 the parties simultaneously

filed briefs on the three legal issues listed above. Simultaneous reply briefs are due on February 23, 2007, and the Court will hear oral argument on March 27,

2007. The Court ordered that all discovery be stayed unless and until the Court orders otherwise. To date, no discovery has occurred in this case. It is not

possible for the Company to quantify the extent of potential liability to the individual defendants, if any. Management does not believe that the lawsuits have

any merit and intends to defend the actions vigorously.

Additionally, the Company is involved in various legal proceedings arising from the normal course of business activities. In management's opinion,

resolution of these matters is not expected to have a material adverse impact on the Company's consolidated results of operations, cash flows or its financial

position. However, depending on the nature and timing of any such dispute, an unfavorable resolution of a matter could materially affect the Company's future

results of operations, cash flows or financial position in a particular period.

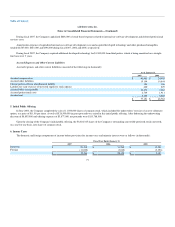

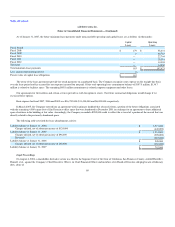

10. Employee Benefit Plan

The Company has a 401(k) plan covering all eligible employees. Since January 1, 2006, the Company has been contributing to the plan. The total

contributions during fiscal 2007 and the last month of fiscal 2006 were $2,919,000 and $318,000, respectively.

11. Related-Party Transactions

In January 1999, the salesforce.com/foundation, commonly referred to as the Foundation, a non-profit public charity, was chartered to build

philanthropic programs that are particularly focused on youth and technology. The Company's chairman is the chairman of the Foundation. He, one of the

Company's officers and one of the Company's board members hold three of the Foundation's eight board seats. The Company is not the primary beneficiary of

the Foundation's activities, and accordingly, the Company does not consolidate the Foundation's statement of activities with its financial results.

Since the Foundation's inception, the Company has provided at no charge certain resources to Foundation employees such as office space. The value of

these items totals approximately $35,000 per quarter.

81