Saab 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 Saab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Threat scenarios and changing security needs, more than

anything else, are driving development in Saab’s markets.

This applies to the defence sector and civil society, as well

as the growing gray zone between them.

Macroeconomic factors and geopolitical developments ultimately

create the framework for Saab’s business. e defence market tradi-

tionally has little co-variation with the global economy. Instead,

political developments are the decisive factor globally, regionally and

locally. Fiscal constraints are obviously aecting defence spending,

however.

A new economic world order is taking shape in which the BRIC

countries (Brazil, Russia, India and China) in particular are gaining

strength. is has not been reected to a great extent in the distribu-

tion of defence spending in recent years. In , total defence

spending increased the most in Asia and the Pacic Rim. Neverthe-

less, the US still accounted for the largest share ( per cent) of the

global total defence spending in . On the other hand, there is

expected to be a shi going forward from traditional to emerging

markets in terms of total global expenditures, although this will level

o in the long term, according to SIPRI.

Growing imbalances in international trade are creating complex

new dependencies and conicts. At the same time, the long-term trend

is toward stronger alliances for peacekeeping and economic develop-

ment purposes, which is increasing security-oriented demand. Joint

commitments to keep conict zones under control are having a similar

eect. Many of the world’s conicts have lasted for long periods. A large

percentage of all armed activities is in these regions, as are preparations

for armed conict by both regional and international players.

e US has retained its role as a geopolitical leader and its impact

on the global security arena. Ideologies have declined in importance

as a driver of global conict scenarios, while religious fundamental-

ism has grown.

As the world’s population continues to grow along with demand for

a higher standard of living, global competition for commodities and

resources, especially fossil fuels, could become an increasingly impor-

tant driver of conicts (see, e.g., “A Strong Britain in an Age of Uncer-

tainty: e National Security Strategy”, October ). In the long run,

access to food and fresh water could also potentially lead to conicts.

e civil market is directly dependent on the economy. Fluctuations

in the economy aect the size of trade volumes and the overall ow

of goods, people, capital and data around the world – as well as the

need for security. e civil aviation market is highly dependent on

the economy, but also extremely sensitive to security threats.

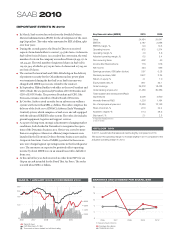

DEFENCE SPENDING 2009

Rank Country

Defence

spending

(USD billion) Global share (%)

1 USA 661.0 43.2

2 China 100.0 1) 6.5 1)

3 France 63.9 4.2

4 UK 58.3 3.8

5 Russia 53.3 1) 3.5 1)

6 Japan 51.0 3.3

7 Germany 45.6 3.0

8 Saudi Arabia 2) 41.3 2.7

9 India 36.3 2.4

10 Italy 35.8 2.3

11 Brazil 26.1 1.7

12 South Korea 24.1 1.6

13 Canada 19.2 1.3

14 Australia 19.0 1.2

15 Spain 18.3 1.2

16 Others 277.8 18.1

Total 1,531.0 100.0

Defence spending at constant prices and exchange rates

Source: SIPRI Yearbook 2010

1) Estimates.

2) Figures for Saudi Arabia include costs for civil security..

Supranational initiatives by the UN, the EU and the African Union

(AU), among others, and other political alliances steer and govern a

large part of the defence and security-oriented civil market. Climate

change is an area where the EU has taken important initiatives. e EU-

nanced research project Clean Sky, which is designed to promote

greener air transports, and SESAR, whose purpose is to modernise traf-

c in the European airspace and reduce its environmental impact, are

two examples. A number of initiatives have also been launched at the

nation state level within the EU. In November , France and England

signed an ambitious defence and security treaty, which entails a far-

DRIVING FORCES AND TRENDS

IN THE MARKET

10 SAAB ANNUAL REPORT 2010

DRIVING FORCES AND TRENDS