Rite Aid 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

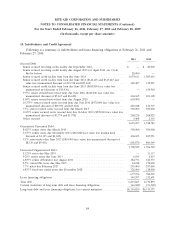

13. Capital Stock

As of February 26, 2011, the authorized capital stock of the Company consists of 1,500,000 shares

of common stock and 20,000 shares of preferred stock, each having a par value of $1.00 per share.

Preferred stock is issued in series, subject to terms established by the Board of Directors.

In fiscal 2006, the Company issued 4,820 shares of Series I Mandatory Convertible Preferred Stock

(‘‘Series I preferred stock’’) at an offering price of $25 per share. Dividends on the Series I preferred

stock were $1.38 per share per year, and were due and payable on a quarterly basis in either cash or

common stock or a combination of both at the Company’s election. In the first quarter of fiscal 2009

the Company entered into agreements with several of the holders of the Series I preferred stock to

convert 2,404 shares into Rite Aid common stock earlier than the mandatory conversion date,

November 17, 2008, at a rate of 5.6561 which resulted in the issuance of 14,648 shares of Rite Aid

common stock. On the mandatory conversion date, the remaining outstanding 2,416 shares of Series I

preferred stock automatically converted at a rate of 5.6561 which resulted in the issuance of 13,665

shares of Rite Aid common stock.

The Company also has outstanding Series G and Series H preferred stock. The Series G preferred

stock has a liquidation preference of $100 per share and pays quarterly dividends at 7% of liquidation

preference. In the fourth quarter of 2009, at the election of the holder, substantially all of the Series G

preferred stock was converted into 27,137 common shares, at a conversion rate of $5.50 per share. The

remaining Series G preferred stock can be redeemed at the Company’s election after January 2009.

The Company has not elected to redeem the remaining Series G preferred stock as of February 26,

2011.

The Series H preferred stock pays dividends of 6% of liquidation preference and can be redeemed

at the Company’s election after January 2010. All dividends can be paid in either cash or in additional

shares of preferred stock, at the election of the Company. Any redemptions are at 105% of the

liquidation preference of $100 per share, plus accrued and unpaid dividends. The Series H shares are

convertible into common stock of the Company, at the holder’s option, at a conversion rate of $5.50

per share. The Company has not elected to redeem the Series H preferred stock as of February 26,

2011.

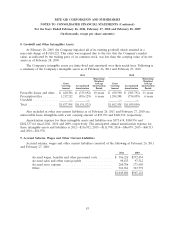

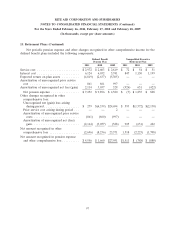

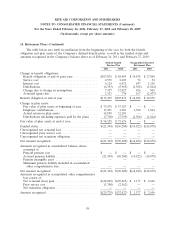

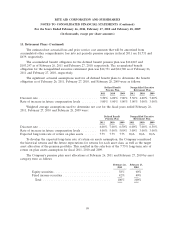

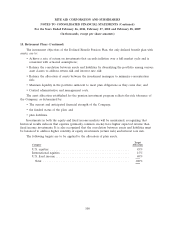

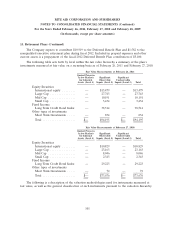

14. Stock Option and Stock Award Plans

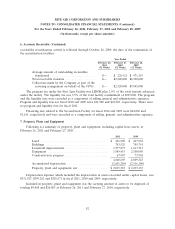

The Company recognizes share-based compensation expense in accordance with ASC 718,

‘‘Compensation—Stock Compensation.’’ Expense is recognized over the requisite service period of the

award, net of an estimate for the impact of forfeitures. Operating results for fiscal 2011, 2010 and 2009

include $17,336, $23,794 and $31,448 of compensation costs related to the Company’s stock-based

compensation arrangements.

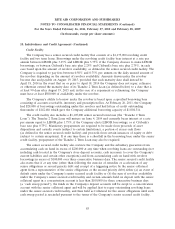

The Company reserved 22,000 shares of its common stock for the granting of stock options and

other incentive awards to officers and key associates under the 1990 Omnibus Stock Incentive Plan (the

1990 Plan), which was approved by the shareholders. Options may be granted, with or without stock

appreciation rights (‘‘SAR’’), at prices that are not less than the fair market value of a share of

common stock on the date of grant. The exercise of either a SAR or option automatically will cancel

any related option or SAR. Under the 1990 Plan, the payment for SARs will be made in shares, cash

or a combination of cash and shares at the discretion of the Compensation Committee.

92