Rite Aid 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

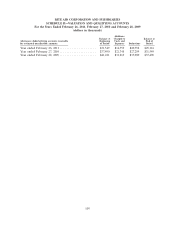

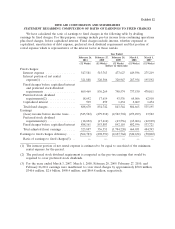

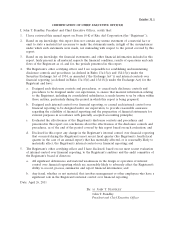

Exhibit 12

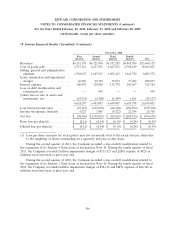

RITE AID CORPORATION AND SUBSIDIARIES

STATEMENT REGARDING COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

We have calculated the ratio of earnings to fixed charges in the following table by dividing

earnings by fixed charges. For this purpose, earnings include pre-tax income from continuing operations

plus fixed charges, before capitalized interest. Fixed charges include interest, whether expensed or

capitalized, amortization of debt expense, preferred stock dividend requirement and that portion of

rental expense which is representative of the interest factor in those rentals.

Year Ended

February 26, February 27, February 28, March 1, March 3,

2011 2010 2009 2008 2007

(52 Weeks) (52 Weeks) (52 Weeks) (52 Weeks) (52 Weeks)

(dollars in thousands)

Fixed charges:

Interest expense ................. 547,581 515,763 477,627 449,596 275,219

Interest portion of net rental

expense(1) .................... 321,888 320,506 320,947 287,934 195,592

Fixed charges before capitalized interest

and preferred stock dividend

requirements .................. 869,469 836,269 798,574 737,530 470,811

Preferred stock dividend

requirements(2) ................ 18,692 17,614 43,536 65,066 62,910

Capitalized interest ............... 509 859 1,434 2,069 1,474

Total fixed charges ................ 888,670 854,742 843,544 804,665 535,195

Earnings:

(Loss) income before income taxes .... (545,582) (479,918) (2,582,794) (273,499) 13,582

Preferred stock dividend

requirements(2) ................ (18,692) (17,614) (43,536) (65,066) (62,910)

Fixed charges before capitalized interest 888,161 853,883 842,110 802,596 533,721

Total adjusted (loss) earnings ........ 323,887 356,351 (1,784,220) 464,031 484,393

Earnings to fixed charges deficiency ..... (564,783) (498,391) (2,627,764) (340,634) (50,802)

Ratio of earnings to fixed charges(3) . . — — — — —

(1) The interest portion of net rental expense is estimated to be equal to one-third of the minimum

rental expense for the period.

(2) The preferred stock dividend requirement is computed as the pre-tax earnings that would be

required to cover preferred stock dividends.

(3) For the years ended March 3, 2007, March 1, 2008, February 28, 2009, February 27, 2010, and

February 26,2011 earnings were insufficient to cover fixed charges by approximately $50.8 million,

$340.6 million, $2.6 billion, $498.4 million, and $564.8 million, respectively.