Rite Aid 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

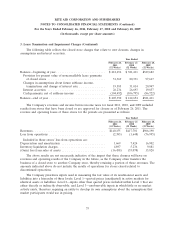

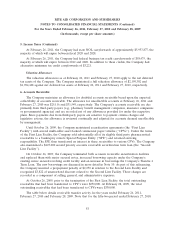

5. Income Taxes (Continued)

At February 26, 2011, the Company had state NOL carryforwards of approximately $5,953,877, the

majority of which will expire between fiscal 2020 and 2028.

At February 26, 2011, the Company had federal business tax credit carryforwards of $58,475, the

majority of which will expire between 2012 and 2020. In addition to these credits, the Company had

alternative minimum tax credit carryforwards of $3,221.

Valuation Allowances

The valuation allowances as of February 26, 2011 and February 27, 2010 apply to the net deferred

tax assets of the Company. The Company maintained a full valuation allowance of $2,199,302 and

$1,984,468 against net deferred tax assets at February 26, 2011 and February 27, 2010, respectively.

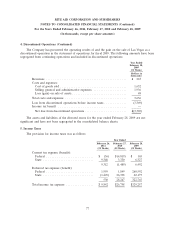

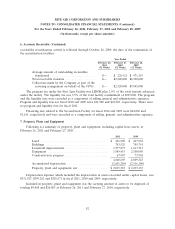

6. Accounts Receivable

The Company maintains an allowance for doubtful accounts receivable based upon the expected

collectibility of accounts receivable. The allowance for uncollectible accounts at February 26, 2011 and

February 27, 2010 was $25,116 and $31,549, respectively. The Company’s accounts receivable are due

primarily from third-party payors (e.g., pharmacy benefit management companies, insurance companies

or governmental agencies) and are recorded net of any allowances provided for under the respective

plans. Since payments due from third-party payors are sensitive to payment criteria changes and

legislative actions, the allowance is reviewed continually and adjusted for accounts deemed uncollectible

by management.

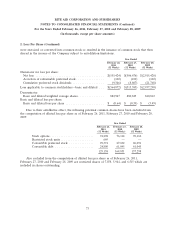

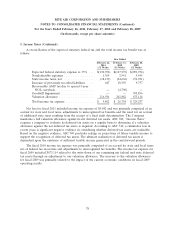

Until October 26, 2009, the Company maintained securitization agreements (the ‘‘First Lien

Facility’’) with several multi-seller asset-backed commercial paper vehicles (‘‘CPVs’’). Under the terms

of the First Lien Facility, the Company sold substantially all of its eligible third party pharmaceutical

receivables to a bankruptcy remote Special Purpose Entity (‘‘SPE’’) and retained servicing

responsibility. The SPE then transferred an interest in these receivables to various CPVs. The Company

also maintained a $225,000 second priority accounts receivable securitization term loan (the ‘‘Second

Lien Facility’’).

On October 26, 2009, the Company terminated both accounts receivable securitization facilities

and replaced them with senior secured notes, increased borrowing capacity under the Company’s

existing senior secured revolving credit facility and an increase in borrowings the Company’s Tranche 4

Term Loan. The new borrowings are discussed in more detail in Note 10. As part of this refinancing,

the Company incurred a prepayment penalty of $2,250 in relation to the Second Lien Facility and

recognized $3,822 of unamortized discount related to the Second Lien Facility. These charges are

recorded as a component of selling, general, and administrative expenses.

At October 26, 2009, prior to the termination of the First Lien Facility, the total outstanding

receivables that had been transferred to CPV’s were $250,000. At February 28, 2009, the total

outstanding receivables that had been transferred to CPVs were $330,000.

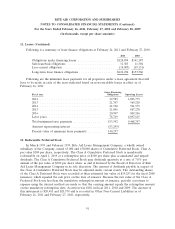

The table below details receivable transfer activity for the years ended February 26, 2011,

February 27, 2010 and February 28, 2009. Note that for the fifty-two period ended February 27, 2010,

81