Rite Aid 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

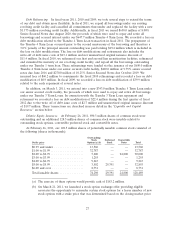

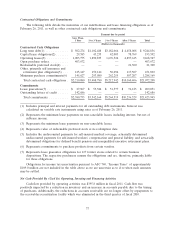

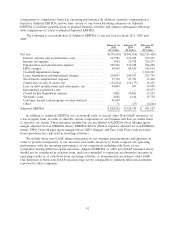

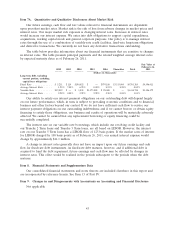

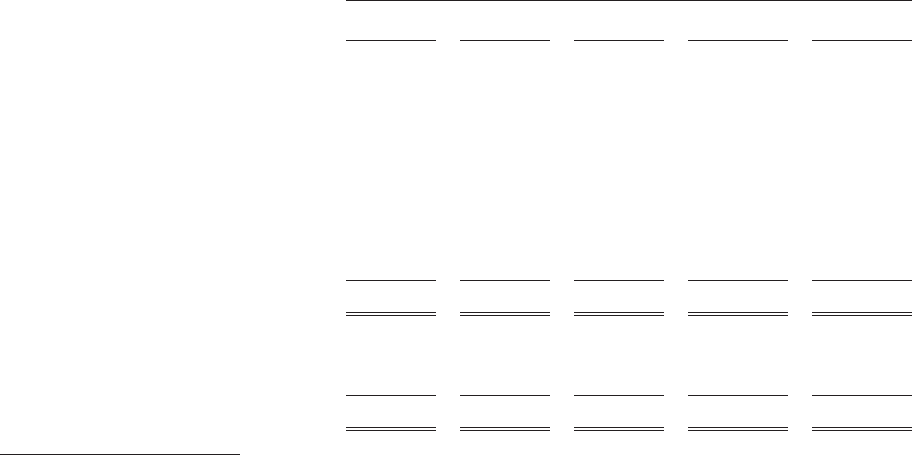

Contractual Obligations and Commitments

The following table details the maturities of our indebtedness and lease financing obligations as of

February 26, 2011, as well as other contractual cash obligations and commitments.

Payment due by period

Less Than

1 Year 1 to 3 Years 3 to 5 Years After 5 Years Total

(Dollars in thousands)

Contractual Cash Obligations

Long term debt(1) ............. $ 502,274 $1,102,488 $3,182,066 $ 4,458,008 $ 9,244,836

Capital lease obligations(2) ....... 29,585 43,235 42,003 78,769 193,592

Operating leases(3) ............ 1,003,775 1,890,833 1,676,524 4,897,615 9,468,747

Open purchase orders ........... 403,672 — — — 403,672

Redeemable preferred stock(4) ....———21,300 21,300

Other, primarily self insurance and

retirement plan obligations(5) . . . 125,147 159,144 50,094 117,507 451,892

Minimum purchase commitments(6) 145,627 293,080 262,255 587,207 1,288,169

Total contractual cash obligations . $2,210,080 $3,488,780 $5,212,942 $10,160,406 $21,072,208

Commitments

Lease guarantees(7) ............ $ 27,967 $ 53,384 $ 51,577 $ 76,123 $ 209,051

Outstanding letters of credit ...... 142,686 — — — 142,686

Total commitments ........... $2,380,733 $3,542,164 $5,264,519 $10,236,529 $21,423,945

(1) Includes principal and interest payments for all outstanding debt instruments. Interest was

calculated on variable rate instruments using rates as of February 26, 2011.

(2) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(3) Represents the minimum lease payments on non-cancelable leases.

(4) Represents value of redeemable preferred stock at its redemption date.

(5) Includes the undiscounted payments for self-insured medical coverage, actuarially determined

undiscounted payments for self-insured workers’ compensation and general liability, and actuarially

determined obligations for defined benefit pension and nonqualified executive retirement plans.

(6) Represents commitments to purchase products from certain vendors.

(7) Represents lease guarantee obligations for 127 former stores related to certain business

dispositions. The respective purchasers assume the obligations and are, therefore, primarily liable

for these obligations.

Obligations for income tax uncertainties pursuant to ASC 740, ‘‘Income Taxes’’ of approximately

$109.0 million are not included in the table above as we are uncertain as to if or when such amounts

may be settled.

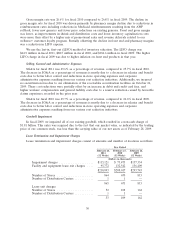

Net Cash Provided By (Used In) Operating, Investing and Financing Activities

Cash flow provided by operating activities was $395.8 million in fiscal 2011. Cash flow was

positively impacted by a reduction in inventory and an increase in accounts payable due to the timing

of purchases. Additionally, the reductions in accounts receivable are no longer offset by repayments to

the receivables securitization facility which was eliminated in the third quarter of fiscal 2010.

37