Rite Aid 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

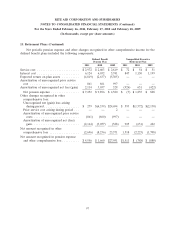

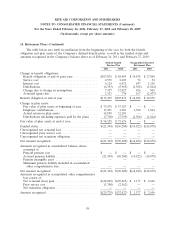

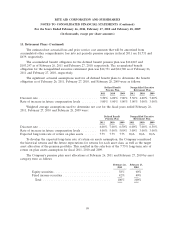

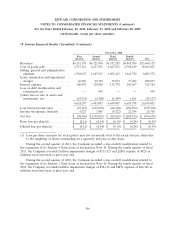

15. Retirement Plans (Continued)

The Company expects to contribute $10,919 to the Deferred Benefit Plan and $1,582 to the

nonqualified executive retirement plan during fiscal 2012. Included in prepaid expenses and other

current assets is a prepayment of the fiscal 2012 Deferred Benefit Plan contribution of $5,100.

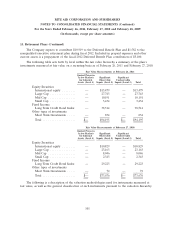

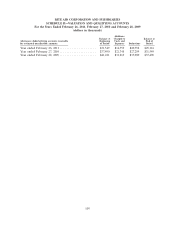

The following table sets forth by level within the fair value hierarchy a summary of the plan’s

investments measured at fair value on a recurring basis as of February 26, 2011 and February 27, 2010:

Fair Value Measurements at February 26, 2011

Quoted Prices in

Active Markets Significant Significant

for Identical Observable Unobservable

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Total

Equity Securities

International equity ........ — $13,479 — $13,479

Large Cap ............... — 27,743 — 27,743

Mid Cap ................ — 10,191 — 10,191

Small Cap ............... — 3,434 — 3,434

Fixed Income

Long Term Credit Bond Index — 38,514 — 38,514

Other types of investments

Short Term Investments ..... — 834 — 834

Total ................... $— $94,195 $— $94,195

Fair Value Measurements at February 27, 2010

Quoted Prices in

Active Markets Significant Significant

for Identical Observable Unobservable

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Total

Equity Securities

International equity ........ — $10,829 — $10,829

Large Cap ............... — 23,163 — 23,163

Mid Cap ................ — 8,046 — 8,046

Small Cap ............... — 2,343 — 2,343

Fixed Income

Long Term Credit Bond Index — 29,223 — 29,223

Other types of investments

Short Term Investments ..... — 72 — 72

Total ................... $— $73,676 $— $73,676

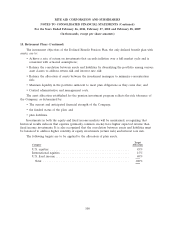

The following is a description of the valuation methodologies used for instruments measured at

fair value, as well as the general classification of such instruments pursuant to the valuation hierarchy.

101