Rite Aid 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

available space. No single front end product category contributed significantly to our sales during fiscal

2011. Our principal classes of products in fiscal 2011 were the following:

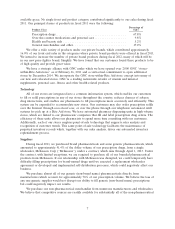

Percentage of

Product Class Sales

Prescription drugs ........................................ 67.8%

Over-the-counter medications and personal care .................. 9.8%

Health and beauty aids .................................... 5.2%

General merchandise and other .............................. 17.2%

We offer a wide variety of products under our private brands, which contributed approximately

16.0% of our front end sales in the categories where private brand products were offered in fiscal 2011.

We intend to increase the number of private brand products during fiscal 2012, many of which will be

in our new price fighter brand, Simplify. We have found that our customers found these products to be

of high quality and provide great value.

We have a strategic alliance with GNC under which we have opened over 2,000 GNC ‘‘stores-

within-Rite Aid-stores’’ as of February 26, 2011 and a contractual commitment to open additional

stores by December 2014. We incorporate the GNC store-within-Rite Aid-store concept into many of

our new and relocated stores. GNC is a leading nationwide retailer of vitamin and mineral

supplements, personal care, fitness and other health related products.

Technology

All of our stores are integrated into a common information system, which enables our customers

to fill or refill prescriptions in any of our stores throughout the country, reduces chances of adverse

drug interactions, and enables our pharmacists to fill prescriptions more accurately and efficiently. This

system can be expanded to accommodate new stores. Our customers may also order prescription refills

over the Internet through www.riteaid.com, or over the phone through our telephonic automated refill

systems for pick up at a Rite Aid store. We have automated pharmacy dispensing units in high volume

stores, which are linked to our pharmacists’ computers that fill and label prescription drug orders. The

efficiency of these units allows our pharmacists to spend more time consulting with our customers.

Additionally, each of our stores employs point-of-sale technology that supports sales analysis and

recognition of customer trends. This same point-of-sale technology facilitates the maintenance of

perpetual inventory records which, together with our sales analysis, drives our automated inventory

replenishment process.

Suppliers

During fiscal 2011, we purchased brand pharmaceuticals and some generic pharmaceuticals, which

amounted to approximately 91.4% of the dollar volume of our prescription drugs, from a single

wholesaler, McKesson Corp (‘‘McKesson’’), under a contract, which runs through April 1, 2013. Under

the contract, with limited exceptions, we are required to purchase all of our branded pharmaceutical

products from McKesson. If our relationship with McKesson was disrupted, we could temporarily have

difficulty filling prescriptions for brand-named drugs until we executed a replacement wholesaler

agreement or developed and implemented self-distribution processes, which could negatively affect our

business.

We purchase almost all of our generic (non-brand name) pharmaceuticals directly from

manufacturers which account for approximately 76% of our prescription volume. We believe the loss of

any one generic supplier would not disrupt our ability to fill generic (non-brand name) prescriptions

but could negatively impact our results.

We purchase our non-pharmaceutical merchandise from numerous manufacturers and wholesalers.

We believe that competitive sources are readily available for substantially all of the non-pharmaceutical

7