Rite Aid 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

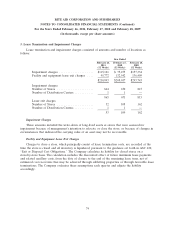

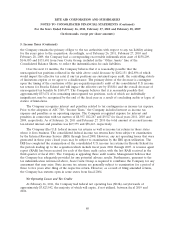

5. Income Taxes (Continued)

the Company remains the primary obligor to the tax authorities with respect to any tax liability arising

for the years prior to the acquisition. Accordingly, as of February 26, 2011, February 27, 2010 and

February 28, 2009, the Company had a corresponding recoverable indemnification asset of $158,209,

$146,053 and $131,681 from Jean Coutu Group, included in the ‘‘Other Assets’’ line of the

Consolidated Balance Sheets, to reflect the indemnification for such liabilities.

Over the next 12 months, the Company believes that it is reasonably possible that the

unrecognized tax positions reflected in the table above could decrease by $202,151 ($62,896 of which

would impact the effective tax rate) if our tax positions are sustained upon audit, the controlling statute

of limitations expires or we agree to a disallowance. The primary driver of the decrease is contingent

upon the timing of the conclusion of the pre-acquisition period’s audit of the consolidated U.S. income

tax returns for Brooks Eckerd and will impact the effective rate by $38,816 and the overall decrease of

unrecognized tax benefits by $168,477. The Company believes that it is reasonably possible that

approximately $33,674 of its remaining unrecognized tax positions, each of which are individually

insignificant, may be recognized by the end of the fiscal year as a result of concluding audits or lapse of

statute of limitations.

The Company recognizes interest and penalties related to tax contingencies as income tax expense.

Prior to the adoption of ASC 740, ‘‘Income Taxes,’’ the Company included interest as income tax

expense and penalties as an operating expense. The Company recognized expense for interest and

penalties in connection with tax matters of $8,937, $12,267 and $9,527 for fiscal years 2011, 2010 and

2009, respectively. As of February 26, 2011 and February 27, 2010 the total amount of accrued income

tax-related interest and penalties was $67,379 and $58,443, respectively.

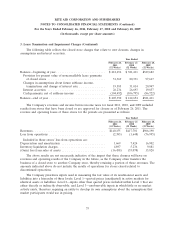

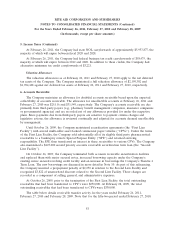

The Company files U.S. federal income tax returns as well as income tax returns in those states

where it does business. The consolidated federal income tax returns have been subject to examination

by the Internal Revenue Service (IRS) through fiscal 2008. However, any net operating losses that were

generated in these prior closed years may be subject to examination by the IRS upon utilization. The

IRS has completed the examination of the consolidated U.S. income tax returns for Brooks Eckerd for

the periods leading up to the acquisition which include fiscal years 2004 through 2007. A revenue agent

report (RAR) has been received for each of the three audit cycles, with the last RAR received in the

third quarter of fiscal 2011. The Company is appealing these audit results. Management believes that

the Company has adequately provided for any potential adverse results. Furthermore, pursuant to the

tax indemnification referenced above, Jean Coutu Group is required to reimburse the Company for any

assessment that may arise. State income tax returns are generally subject to examination for a period of

three to five years after filing of the respective return. However, as a result of filing amended returns,

the Company has statutes open in some states from fiscal 2004.

Net Operating Losses and Tax Credits

At February 26, 2011, the Company had federal net operating loss (NOL) carryforwards of

approximately $3,823,542, the majority of which will expire, if not utilized, between fiscal 2019 and

2022.

80