Rite Aid 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

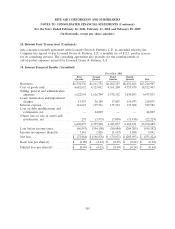

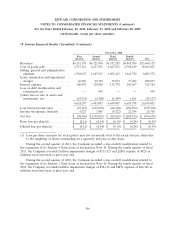

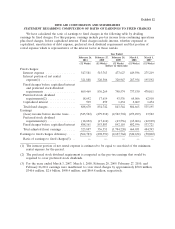

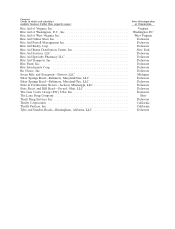

20. Financial Instruments

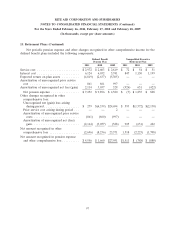

The carrying amounts and fair values of financial instruments at February 26, 2011 and

February 27, 2010 are listed as follows:

2011 2010

Carrying Fair Carrying Fair

Amount Value Amount Value

Variable rate indebtedness ..... $1,425,019 $1,386,861 $2,120,618 $1,990,963

Fixed rate indebtedness ....... $4,654,548 $4,544,974 $4,097,590 $3,632,738

Cash, trade receivables and trade payables are carried at market value, which approximates their

fair values due to the short-term maturity of these instruments.

The following methods and assumptions were used in estimating fair value disclosures for financial

instruments:

LIBOR-based borrowings under credit facilities:

The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and term

notes are estimated based on the quoted market price of the financial instruments.

Long-term indebtedness:

The fair values of long-term indebtedness are estimated based on the quoted market prices of the

financial instruments. If quoted market prices were not available, the Company estimated the fair value

based on the quoted market price of a financial instrument with similar characteristics.

21. Subsequent Events

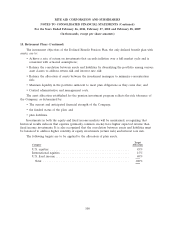

As of February 26, 2011, the Company had a $342,125 senior secured term loan (the ‘‘Tranche 3

Term Loan’’) outstanding under the Company’s existing senior secured credit facility. On March 3,

2011, the Company refinanced its Tranche 3 Term Loan with a $343,000 senior secured term loan (the

‘‘Tranche 5 Term Loan’’). The Tranche 5 Term Loan matures on March 3, 2018, although the maturity

shall instead be December 1, 2014 in the event that the Company does not repay or refinance the

outstanding 8.625% senior notes due 2015 prior to that time, or September 16, 2015, in the event that

the Company does not repay or refinance the outstanding 9.375% senior notes due 2015 prior to that

time. The Tranche 5 Term Loan bears interest at a rate per annum equal to LIBOR plus 3.25% with a

1.25% LIBOR floor, and is subject to a 1% prepayment fee in the event it is refinanced within the first

year after issuance with the proceeds of a substantially concurrent issuance of new loans or other

indebtedness incurred for the primary purpose of repaying, refinancing or replacing the Tranche 5 Term

Loan. Mandatory prepayments are required to be made from proceeds of asset dispositions and

casualty events (subject to certain limitations), a portion of excess cash flows (as defined in the senior

secured credit facility) and proceeds from certain issuances of equity or debt (subject to certain

exceptions). If at any time there is a shortfall in the borrowing base under the senior credit facility,

prepayment of the Tranche 5 Term Loan may also be required. In connection with the Tranche 3 Term

Loan repayment and retirement, the Company will record a loss on debt modification of $22.4 million

107