Rite Aid 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Debt Refinancing: In fiscal years 2011, 2010 and 2009, we took several steps to extend the terms

of our debt and obtain more flexibility. In fiscal 2011, we repaid all borrowings under our existing

revolving credit facility and cancelled all commitments thereunder and replaced the facility with a new

$1.175 million revolving credit facility. Additionally, in fiscal 2011 we issued $650.0 million of 8.00%

Senior Secured Notes due August 2020, the proceeds of which were used to repay and retire all

borrowings and accrued interest under our $647.7 million Tranche 4 Term Loan. We recorded a loss on

debt modification related to the Tranche 4 Term Loan transaction in fiscal 2011. The prepayment of

the Tranche 4 Term Loan occurred prior to the second anniversary of the borrowing and therefore a

3.0% penalty of the principal amount outstanding was paid totaling $19.4 million which is included in

the loss on debt modifications. The loss on debt modifications and retirements also includes the

write-off of debt issue costs of $13.1 million and net unamortized original issuance discount of

$11.4 million. In fiscal 2010, we refinanced our first and second lien securitization facilities, refinanced

and extended the maturity of our revolving credit facility, and repaid all the borrowings outstanding

under our Tranche 1 term loan. These refinancings were funded via the issuance of our $650.0 million

Tranche 4 Term Loan under our senior secured credit facility, $410.0 million of 9.75% senior secured

notes due June 2016 and $270.0 million of 10.25% Senior Secured Notes due October 2019. We

incurred fees of $60.2 million to consummate the fiscal 2010 refinancings and recorded a loss on debt

modification of $0.9 million. In fiscal 2009, we recorded a loss on debt modification of $39.9 million

related to the early repayment of several notes.

In addition, on March 3, 2011, we entered into a new $343.0 million Tranche 5 Term Loan under

our senior secured credit facility, the proceeds of which were used to repay and retire all borrowings

under our Tranche 3 Term Loans. In connection with the Tranche 3 Term Loan repayment and

retirement we recorded a loss on debt modification of $22.4 million during the first quarter of fiscal

2012 due to the write off of debt issue costs of $2.7 million and unamortized original issuance discount

of $19.7 million. These transactions are described in more detail in the ‘‘Liquidity and Capital

Resources’’ section below.

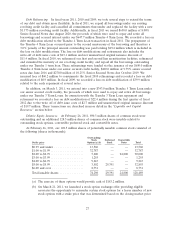

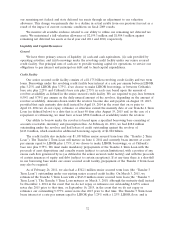

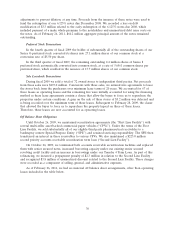

Dilutive Equity Issuances. At February 26, 2011, 890.3 million shares of common stock were

outstanding and an additional 128.5 million shares of common stock were issuable related to

outstanding stock options, convertible preferred stock and convertible notes.

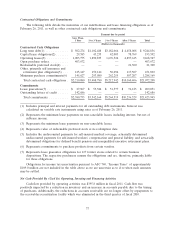

At February 26, 2011, our 128.5 million shares of potentially issuable common stock consisted of

the following (shares in thousands):

Outstanding

Stock Preferred Convertible

Strike price Options(a)(b) Stock Notes Total

$0.99 and under ................. 13,560 — — 13,560

$1.00 to $1.99 ................... 32,787 — — 32,787

$2.00 to $2.99 ................... 5,200 — 24,800 30,000

$3.00 to $3.99 ................... 1,255 — — 1,255

$4.00 to $4.99 ................... 9,243 — — 9,243

$5.00 to $5.99 ................... 3,502 29,391 — 32,893

$6.00 and over .................. 8,751 — — 8,751

Total issuable shares .............. 74,298 29,391 24,800 128,489

(a) The exercise of these options would provide cash of $183.2 million.

(b) On March 21, 2011, we launched a stock option exchange offer providing eligible

associates the opportunity to surrender certain stock options for a lesser number of new

stock options with a strike price that was determined based on the closing market price

27