Qantas 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61Qantas |Annual Report 2007

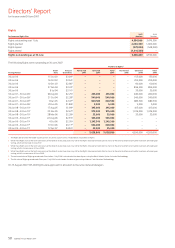

Directors’ Report

for the year ended 30 June 2007

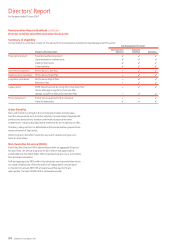

There is differentiated distribution of the pool to Executives based on the IPF.

Shares are purchased on-market or issued and are held subject to

a holding lock for 10 years. However, Executives can call for the deferred

shares prior to the expiration of the holding lock, but not before the end

of one year from the completion of the performance period for up to half

of the deferred shares and the end of two years in relation to the

remaining deferred shares. Any dividends paid on the deferred shares

during the holding lock period will be distributed to the relevant Executive.

Generally, any deferred shares which remain subject to the holding lock

will be forfeited if the relevant Executive ceases employment with the

Qantas Group.

Performance measures and rationale

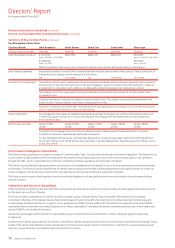

For 2006/07, the PSP target was a Balanced Scorecard of Customer,

Operational, People and Financial measures. Customer satisfaction is

measured by reference to an external Skytrax survey. The operational

performance (punctuality) measure relates to the metrics published

monthly by the government. People performance is focused on

occupational health and safety using Australian standards for calculating

Lost Time Injury Frequency Rate (LTIFR). Financial performance uses an

internal unit cost measure.

The Balanced Scorecard performance criteria aims to align Executive

remuneration with the key value drivers for the Qantas Group and

complements the short-term financial targets which are the focus

of the PCP.

The targets are set by the Board annually at the start of the year.

Readily available external measures are used where appropriate. Internal

measures are used in relation to key focus areas (Safety and Unit Costs).

The mandatory minimum holding lock, of between one and two years,

provides this Plan with its medium-term focus on share price.

At the conclusion of the year the Balanced Scorecard results are provided

to the Board so it can make an assessment as to whether the targets have

been met and whether the deferred shares are subsequently granted.

Determining Payment Pool

The ‘at target’ pool, i.e. the amount that would deliver the full PSP award

to all participating Executives, is available when the Balanced Scorecard

targets approved by the Board are met.

Determining Individual Payments

Each individual’s ‘at target’ payment is determined by Qantas Group

performance and the pool awarded as described above. An Executive’s actual

reward is calculated by multiplying their ‘at target’ PSP award by their IPF.

The grant date and number of deferred shares awarded to Key

Management Personnel are outlined on page 108.

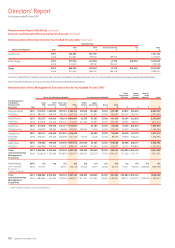

Performance Rights Plan

Purpose

The PRP is the long-term element of the Performance Equity Plan. It has

been implemented as a reward program that aligns the interests of

participating Executives with the longer term interests of shareholders.

It also helps to retain participating Executives.

Approach

Annual grants of performance rights are awarded to selected individuals.

Subject to achievement against the three year performance hurdle

relating to each grant, the Rights may be converted (on a one-for-one

basis) to Qantas shares. Shares are purchased on-market or issued.

Performance measures and rationale

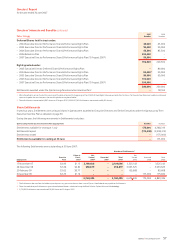

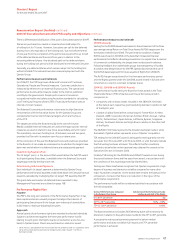

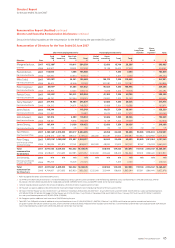

2003/04 Awards

Vesting for the 2003/04 award was based on the achievement of the three

year average annual Return on Total Gross Assets (RoTGA) targets over the

three years ended 30 June 2006. The performance condition of target

RoTGA was chosen in 2003/04 on the basis that it measures financial

performance that reflects a Board approved return on capital. Due to reasons

of commercial confidentiality, the targets were not disclosed in advance.

Following feedback from stakeholder groups that transparency of hurdles

should be a key design feature for the PRP, Qantas discontinued the use of

this RoTGA based approach for future awards of Rights from 2004/05.

The RoTGA target was achieved for the three year performance period

and the Rights granted under the 2003/04 award vested in full and were

converted on a one-for-one basis to Qantas shares.

2004/05, 2005/06 and 2006/07 Awards

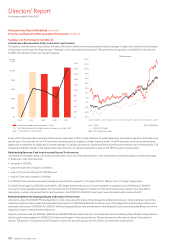

The performance hurdle set by the Board for these awards is the Total

Shareholder Return (TSR) of Qantas over the performance period in

comparison to:

companies with ordinary shares included in the S&P/ASX 100 Index

at the date of each respective grant (excluding Qantas) in relation to half

of the Rights; and

a basket of global listed airlines comprising Air France-KLM, Air New

Zealand, AMR Corporation (American Airlines), British Airways, Cathay

Pacific, Delta Airlines1, Japan Airlines, Lufthansa, Ryanair, Singapore

Airlines, Southwest Airlines and Virgin Blue in relation to the other half

of the Rights.

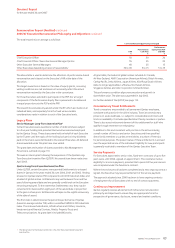

The S&P/ASX 100 Index represents the broader Australian market, while

the basket of global airlines represents a mix of Qantas’ competitors.

TSR testing for the 2004/05 award is being performed quarterly over the

two years from 30 June 2007 until 30 June 2009, or until the tests indicate

that full vesting has been achieved. This reflects the Plan conditions

outlined to shareholders when approval was obtained for awards to the

Executive Directors in October 2004.

Similarly TSR testing for the 2005/06 and 2006/07 awards occurs during

the period between three and five years from award, in accordance with

the conditions of the awards approved by shareholders.

Testing over these timeframes recognises that Qantas is exposed to a high

degree of business and share price volatility compared to many other

major Australian companies. As the award date remains the base point for

comparison, it ensures that there is no reduction in the rigour of the

performance requirement.

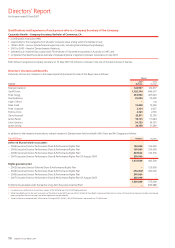

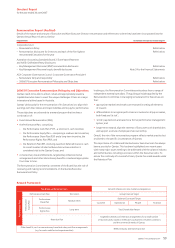

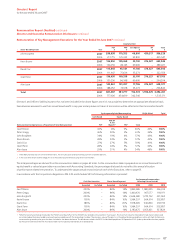

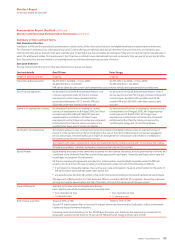

The performance hurdle will be considered satisfied in accordance with

the following table:

Qantas TSR Performance Compared

to the Relevant Peer Group

Satisfaction of the Performance Hurdle

relatingtoeachhalfoftheRights

0 to 49th percentile Nil

50th to 74th percentile 50% – 99%

75th to 100th percentile 100%

The Board resolved at its October 2005 Meeting that it will not exercise its

discretion in relation to the performance hurdle for the 25th to 49th percentile.

A progressive vesting scale prevents payment for below median

performance and does not deliver full reward until 75th percentile

performance is achieved.

•

•

Delta Airlines is excluded from the airline basket for the 2006/07 award as in September 2005

Delta Airlines filed voluntary petitions for reorganisation under Chapter 11 of the US

Bankruptcy Code.

1

Remuneration Report (Audited) continued

2006/07 Executive Remuneration Philosophy and Objectives continued