Qantas 2007 Annual Report Download - page 53

Download and view the complete annual report

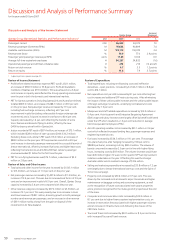

Please find page 53 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Discussion and Analysis of the Income Statement continued

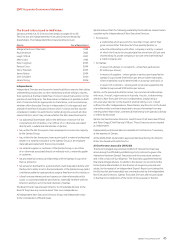

Depreciation and amortisation increased by $112.9 million or 9.0 per

cent reflecting increased depreciation on aircraft modifications and

capitalised maintenance.

Non-cancellable operating lease rentals increased by $59.6 million or

16.8 per cent reflecting the full year impact of 15 Jetstar A320 aircraft

and nine B738 aircraft delivered in the prior year.

Capacity hire costs decreased by $66.4 million or 18.0 per cent largely

due to a move to a freesale codeshare arrangement with Air Pacific and

Air Vanuatu and the return of five BAE 146 aircraft during the current

and prior years.

Other expenditure increased by $215.0 million or 49.2 per cent largely

due to a loss on foreign currency hedges in the current year compared to

a gain in the prior year (largely attributable to US dollar hedging), the

impairment of the investment in Air New Zealand and higher legal and

consultancy fees.

The share of net profit in associates and jointly controlled entities

increased by $7.6 million to $46.5 million. The main contributors to

this result were the investments in Star Track Express and Australian

air Express.

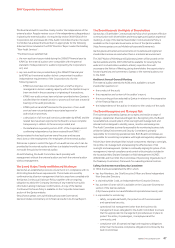

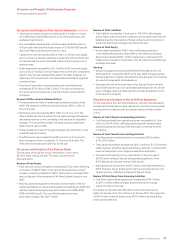

Review of Other Income Statement Items

The requirement to mark-to-market open derivative positions under

AASB 139 resulted in ineffective derivative losses of $54.1 million in

the current year.

Net finance costs decreased by $39.7 million or 72.7 per cent. This

reflects additional interest received from a higher average cash balance

and interest revenue on the unwinding of the discount on liquidated

damages. This was offset by higher financing costs associated with

higher interest rates on debt.

The favourable net impact of foreign exchange rate movements on the

overall PBT was $2.0 million.

The effective tax rate increased from 28.5 per cent to 30.3 per cent.

Basic earnings per share increased by 11.5 cents to 36.4 cents. This

reflected the increased profit after tax for the year.

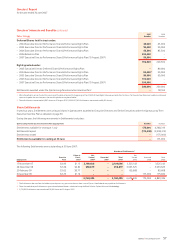

Discussion and Analysis of the Balance Sheet

The net assets of the Qantas Group increased by 1.9 per cent to

$6,195.0 million during the year. The major movements are

discussed below.

Review of Total Assets

Total cash and current receivables increased by $713.4 million reflecting

an increase of $460.9 million in net cash as discussed below, and an

increase in current receivables of $252.5 million due to increased traffic

and the disposal of the investment of Air New Zealand Limited in June

2007.

Property, plant and equipment remained consistent which reflected

capital expenditure on new aircraft acquisitions including one A330-300

and three Q400, and progress payments made on the A380, B787,

B738 and A330 aircraft. This was offset by depreciation and

amortisation charge of $1,362.7 million.

•

•

•

•

•

•

•

•

•

•

•

Review of Total Liabilities

Total liabilities increased by 2.4 per cent to $13,410.7 million largely

due to higher revenue received in advance and increased other financial

liabilities driven by the maturity of hedge contracts and movements in

fuel prices and foreign exchange rates during the year.

Review of Total Equity

Issued capital increased by $99.0 million reflecting participation

in the Dividend Reinvestment Plan (DRP) for the 2006 final dividend.

Reserves decreased by $181.1 million mainly due to a decrease in the

hedge reserve caused by movements in the fair value of fuel and foreign

exchange derivatives.

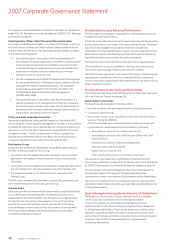

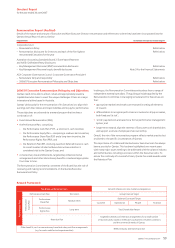

Gearing

Qantas Group gearing (including off Balance Sheet debt) at 30 June

2007 was 39:61 compared to 45:55 at 30 June 2006. The gearing ratio

has decreased due to higher cash balances and a decrease in borrowings

as a result of repayments and revaluations.

Gearing is the ratio of the book value of the Qantas Group’s net debt

(short and long-term plus non-cancellable operating leases less the fair

value of hedges relating to debt and cash and cash equivalents) to the

book value of total equity.

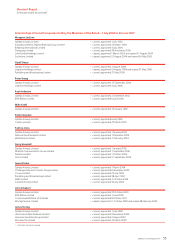

Discussion and Analysis of the Cash Flow Statement

For the purposes of the Cash Flow Statement, cash and cash equivalents

includes cash at bank and on hand, cash at call, short-term money market

securities and term deposits with an original maturity of three months

or less.

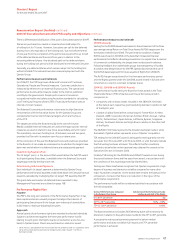

Review of Cash Flows From Operating Activities

Cash flows provided from operating activities increased by 16.2 per

cent to $2,353.4 million, reflecting revenue growth during the year

and strong advance bookings reflected as cash in revenue received

in advance.

Review of Cash Flows From Investing Activities

Cash flows used in investing activities increased by $330.6 million

to $1,220.2 million.

Total capital expenditure decreased by $291.2 million to $1,235.9 million

reflecting lower aircraft progress and delivery payments, combined with

lower reconfiguration costs, engine modifications and spares.

Proceeds from financing of non-current assets in the prior year of

$627.8 million relates to the sale and operating leaseback of nine

B737-800 aircraft and seven Jetstar A320 aircraft.

Net payments for investments of $32.1 million reflected investments in

DPEX Transport Group, Kilda Express and the remaining interest in Jet

Turbine Services, offset by the disposal of Thai Air Cargo.

Review Of Cash Flows From Financing Activities

Cash flows used in financing activities increased by $534.1 million

to $672.3 million reflecting higher dividend and net borrowing

payments in the current year.

The Qantas Group held cash of $3,362.9 million and had access to

additional funding of $1,170.0 million as at 30 June 2007. This comprised

a $500.0 million stand-by facility and a $670.0 million revolving facility

under a syndicated loan.

•

•

•

•

•

•

•

•

•

•

51Qantas |Annual Report 2007

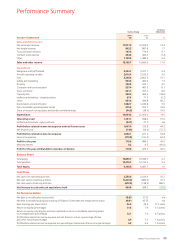

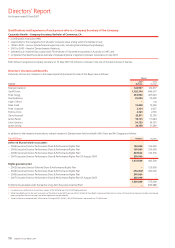

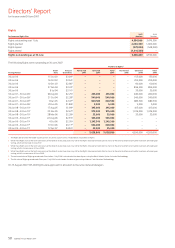

Discussion and Analysis of Performance Summary

for the year ended 30 June 2007