Qantas 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60 Qantas |Annual Report 2007

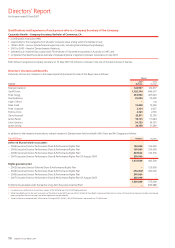

Directors’ Report

for the year ended 30 June 2007

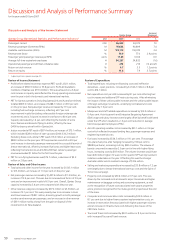

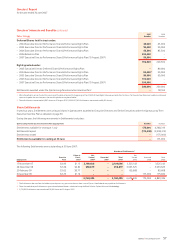

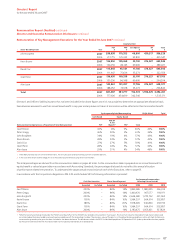

Fixed Annual Remuneration

Salary decisions are based on FAR, which involves a guaranteed salary level

from which superannuation and certain other benefits, such as a

maintained motor vehicle, can be deducted at the election of the

employee on a salary sacrifice basis.

FAR is set with reference to market data, reflecting the scope of the role,

the unique value of the role and the performance of the person in the role.

FAR is reviewed annually and reflects a middle-of-the-market approach,

as compared to similar comparative roles within Australia, with particular

reference to large public companies for the most senior roles.

Cash FAR, as disclosed in the remuneration tables, is the FAR remaining

after salary sacrifice components such as motor vehicles and

superannuation have been deducted.

Performance Plan

Cash and equity incentives are delivered through the Performance Plan.

Performance Cash Plan

Purpose

The PCP is a cash incentive paid to Executives when the Qantas Group’s

key financial target is achieved over the year.

Approach

A cash pool for PCP awards to Executives is triggered if a threshold level of

performance against the Qantas Group financial target is met. This means

the Qantas Group financial result for the year is the first hurdle required to

be satisfied.

For each participating Executive, the target reward under the PCP is set as

a percentage of FAR. This percentage varies according to the Executive’s

level of responsibility. There is differentiated distribution of the bonus

payment pool to Executives based on individual performance.

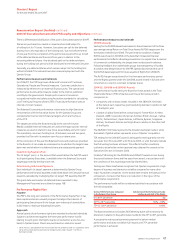

Performance measures and rationale

Determining Payment Pool

For 2006/07, the financial target was profit before related income tax

expense (PBT) adjusted for approved restructuring costs, changes in

accounting policy and the profit impact of A-IFRS ineffective derivatives.

The selection of PBT reflects the use of this measure as a key budget and

financial measure both at Group and segment level within the Qantas

Group. This single measure applies to all Executives and results in no

payment when profitability hurdles are not achieved.

The target is set annually as part of the budgeting process and approved

by the Board. At the conclusion of the year, the adjusted PBT result is

provided to the Board. The Board approves the size of the pool based on

these results.

The ‘at target’ pool, i.e. the amount that would deliver the full PCP award

to all participating Executives, is available when the target approved by the

Board is met.

The threshold for payment is 75 per cent of target PBT. At the threshold,

half of the PCP pool is available for distribution.

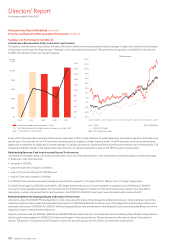

In the six years that the PCP has been in place, the full ‘at target’ payment

has been achieved on two occasions and exceeded twice, with partial

payment on one occasion and one year of nil payment.

Determining Individual Payments

Differentiation of payments among Executives based on individual

performance is an important part of the approach to performance

management at Qantas. The performance of each individual is assessed

against their KPIs for the year, and an Individual Performance Factor (IPF)

assigned at year end. At the beginning of each year, performance

objectives are set in the areas of customer service, operational

performance, people achievements and financial performance. At the end

of the year each Executive’s contribution is assessed against these criteria.

Their contribution is also considered relative to other Executives in

determining their IPF.

An Executive’s actual reward is calculated by multiplying their ‘at target’

payment by their IPF. IPFs are generally in the range of 0.8 to 1.2 but can

be down to 0 or up to 2.0. Across the group, IPFs are targeted to an

average of 1, ensuring that differentiation occurs, but without increasing

the cost of the bonus pool.

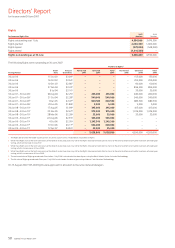

For example, if the Qantas Group PBT target is achieved and the Board

award 100 per cent of the PCP pool, the reward under this plan for a

Manager on FAR of $120,000 with an ‘at target’ PCP opportunity of

10 per cent and an IPF 0.9 would be:

$120,000 (FAR)

x 10 per cent (‘at target’ opportunity)

x 100 per cent (PCP pool if Group target is met)

x 0.9 (IPF based on differentiated assessment)

= $10,800.

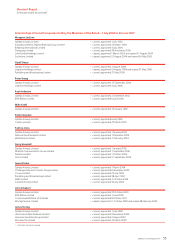

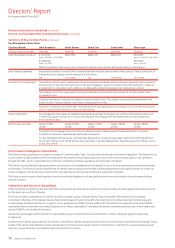

Performance Equity Plan

The Performance Equity Plan comprises the PSP (a medium-term incentive)

and the PRP (a long-term incentive). Both elements are designed to

strengthen the alignment of the interests of Executives with those of

shareholders.

The equity benefits under the Performance Equity Plan are delivered under

the Terms & Conditions and various rules of the Qantas Deferred Share Plan

(DSP). The DSP Terms & Conditions were initially approved by shareholders

at the 2002 AGM. At the 2006 AGM, shareholders again approved the DSP

as the vehicle for the provision of equity benefits by Qantas.

At its July 2006 Meeting, the Board resolved to amend the definition of

Eligible Employee in the DSP Terms & Conditions to read “employees

(including Directors) of the Group whom the Board determines to be

eligible for an offer.”

There have been no other changes to the DSP Terms & Conditions during

the year.

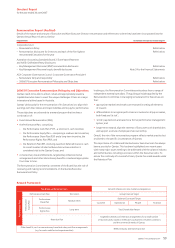

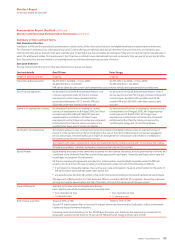

Performance Share Plan

Purpose

The PSP is a medium-term deferred share incentive designed to reward

Executives when a Balanced Scorecard of key Qantas Group measures

(detailed below) is achieved over the year and to encourage retention

through a two year deferral period.

Approach

For each participating Executive, the target reward under the plan is set as

a percentage of FAR. This percentage varies according to the Executive’s

level of responsibility.

On an annual basis, the Board approves awards under the PSP based on

the achievement by the Qantas Group against the Balanced Scorecard of

Customer, Operational, People and Financial measures. Each measure is

assessed separately for performance against target and threshold.

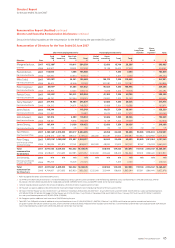

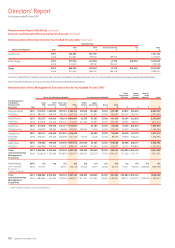

Remuneration Report (Audited) continued

2006/07 Executive Remuneration Philosophy and Objectives continued