Porsche 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The net liquidity, i.e. cash and cash equiva-

lents less liabilities to banks, of the Porsche SE

group, thus not taking into consideration the Porsche

Zwischenholding GmbH group and the Volkswagen

group, improved considerably in a year-on-year com-

parison also due to the deconsolidation of the Por-

sche Zwischenholding GmbH group, amounting to

minus 6,047 million euro as of 31 July 2010.

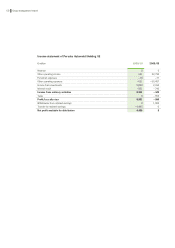

Results of operations

At the end of the fiscal year 2009/10, the

Porsche SE group reports a loss after tax of 454 mil-

lion euro, following a loss after tax of 3,563 million

euro recorded for the same period in the prior year.

The prior-year loss after tax had been affected above

all by effects from market valuation of cash-settled

options for Volkswagen AG shares, by expenses from

the amortization of hidden reserves and liabilities

identified in the course of purchase price allocation

for the purpose of first-time consolidation in full of the

Volkswagen group and by the difficult economic situa-

tion. In contrast, the loss after tax for the fiscal year

2009/10 was heavily influenced by the structural

changes described. The deconsolidations also have a

considerable impact on the structure of the income

statement of the Porsche SE group.

The Porsche Zwischenholding GmbH group

and the Volkswagen group are classified as discontin-

ued operations in accordance with IFRSs and their

earnings are reported in a separate line in the income

statement until their respective date of deconsolida-

tion. The corresponding figures in the income state-

ment for the fiscal year 2008/09 were adjusted to

account for these changes. The contributions of the

Porsche Zwischenholding GmbH group (prior year:

Porsche subgroup, i.e. Porsche AG and its subsidiar-

ies) and the Volkswagen group (prior year: Volks-

wagen subgroup) were thus reclassified to profit/loss

from discontinued operations.

The profit/loss from discontinued operations

includes the current results of the Porsche Zwischen-

holding GmbH group and Volkswagen group until the

date of their deconsolidation on 7 December 2009

and 3 December 2009, respectively. It also includes

the result from the deconsolidation of both groups.

Until the date of their deconsolidation, the

Porsche Zwischenholding GmbH group and the Volks-

wagen group recorded total revenue of 46,349 million

euro. All in all, the profit after tax of the two groups

until deconsolidation including costs arising from the

amortization of the hidden reserves and liabilities

identified in the course of the purchase price alloca-

tion for the Volkswagen group as of 5 January 2009

amounted to 680 million euro. This amount also in-

cludes the income from the disposal of other com-

prehensive income of 890 million euro.

The result from deconsolidation of the two

groups is the difference between the respective fair

value of the investment and the net assets including

the shares of other comprehensive income attribut-

able to the Volkswagen group and the Porsche

Zwischenholding GmbH group and the non-controlling

interests. The stock market price of the shareholding

in Volkswagen AG on the date of deconsolidation was

used to determine the fair value of the Volkswagen

group. The fair value of the Porsche Zwischenholding

GmbH group is derived based on the values underly-

ing the capital increase at Porsche Zwischenholding

GmbH and consequently Volkswagen AG’s investment

in Porsche Zwischenholding GmbH. The loss arising

from the deconsolidation of the Volkswagen group of

15,902 million euro was partially offset by the posi-

tive contribution to profit/loss from the deconsolida-

tion of the Porsche Zwischenholding GmbH group of

9,027 million euro. The deconsolidation of the two

groups consequently gives rise to a loss of 6,875

million euro, which means that profit/loss after taxes

from discontinued operations comes to a total of mi-

nus 6,195 million euro.

The profit/loss from continuing operations in-

cludes the earnings of Porsche SE and its subsidiar-

ies and the profit/loss from investments accounted

for at equity attributable to the Porsche SE group

from its investment in the Porsche Zwischenholding

GmbH group and the Volkswagen group. In particular,

it includes the effect recognized in the income state-

ment arising from the first-time inclusion of the in-

vestment in Volkswagen AG at equity.

56 Group management report