Porsche 2009 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2009 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275

|

|

228 Financials

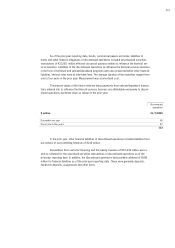

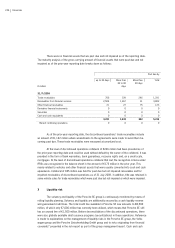

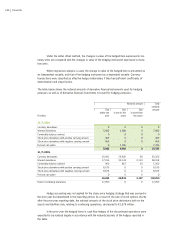

The financial guarantees mostly relate to financial liabilities of the Porsche Zwischenholding

GmbH group. Volkswagen AG has issued a financial guarantee for 49.9% of these financial liabilities;

this is equivalent to a hold harmless agreement of €1,621 million. There was no liquidity risk from

financial guarantees in the prior year, as the Porsche Zwischenholding GmbH group was fully con-

solidated as of 31 July 2009 and the basic agreement and related agreements implementing it did

not exist at that time.

The cash outflows from irrevocable credit commitments as of the prior-year reporting date,

classified by contractual maturities, are presented in note [33].

There are no significant concentrations of risk that are not evident from the notes to the fi-

nancial statements and management report.

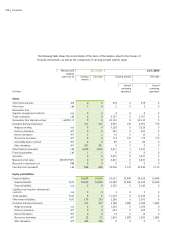

4 Market risk

4.1 Hedging policy and financial derivatives

During the course of its general business activities, the continuing operations are exposed

to interest rate risks, stock price risks and risks from put and call option for the remaining shares in

Porsche Zwischenholding GmbH. Before deconsolidation of the discontinued operations, there were

also currency, commodity and fund price risks. The risks of continuing operations arise from financ-

ing activities, the remaining cash-settled options relating to shares in Volkswagen AG, fluctuation in

the enterprise value of Porsche Zwischenholding GmbH and to a small extent from cash investments.

Before deconsolidation of the discontinued operations, the risks of discontinued operations addi-

tionally included risks from foreign currency transactions in the course of ordinary operations, fund

price risks and risks in connection with the purchasing of commodities. It is company policy to

exclude or limit these risks by entering into hedge transactions. All necessary hedging measures

are coordinated by the finance department of the Porsche SE group or, before deconsolidation of

the discontinued operations, were also performed and coordinated by the respective operations’

group treasury departments.

The nature and volume of hedging transactions is generally chosen with regard to the hed-

ged item. Hedging transactions may only be concluded to hedge existing underlyings or forecast

transactions. Only financial instruments approved by type and volume may be entered into with

approved counterparties.

There are no significant concentrations of risk that are not evident from the notes to the fi-

nancial statements or management report.

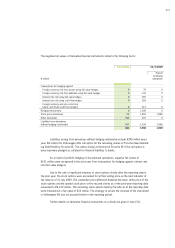

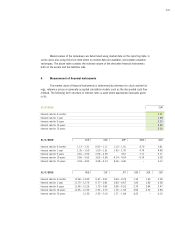

The Porsche SE group uses two different methods to present market risk from non-

derivative and derivative financial instruments in continuing operations in accordance with IFRS 7.

The exposure to market price risk from interest hedging and from the put and call option for the

remaining shares in Porsche Zwischenholding GmbH was calculated using a sensitivity analysis, and

a value-at-risk model was used for stock price risks. Due to deconsolidation of the discontinued

operations in the fiscal year 2009/10, the presentation of risks in the reporting period differs from

that of the prior year in that they are not presented separately for financial services and the auto-