Porsche 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Business development

Back on track for growth

In 2010 the global economy began to re-

cover from the worst recession seen in the past few

decades and returned to growth. According to a fore-

cast by the International Monetary Fund (IMF) the

global economy is likely to grow by 4.6 percent by

the end of the calendar year. The driving forces be-

hind the rapid upwards development are China and

India, while impetus is also coming from Brazil. The

leading industrialized countries to record the largest

growth in the reporting period were the USA and Can-

ada. In Europe, Germany was able to benefit from the

global economic recovery through its traditionally high

share of exports. In contrast, the southern EU mem-

ber states Greece, Italy, Spain and Portugal in particu-

lar suffered from the effects of their considerable

budget deficits. On the whole, the upswing in Europe

was moderate compared to the growing markets of

Asia and America.

The severe crisis that the global economy

has been through had a range of effects on the inter-

national automotive markets in the reporting period.

Whereas many EU states used government incentives

in the form of tax reductions or an environmental bo-

nus to stabilize the overall level of sales, eastern

Europe saw a dramatic slump in vehicles sales. The

United States initially also saw a rapid downward spi-

ral until the North American market started to recover

in 2010. By contrast, the Asian emerging countries

China and India along with Brazil in South America

continued to record high growth rates. Manufacturers

of small and compact cars benefitted to a much

greater extent from government stimulus programs

than the manufacturers of expensive luxury vehicles.

The following statements on sales, produc-

tion, financial services and employees only take into

consideration operating developments at the Porsche

Zwischenholding GmbH group, comprising Porsche

AG and its subsidiaries, and at the Volkswagen group,

and do not take into account the Porsche SE group.

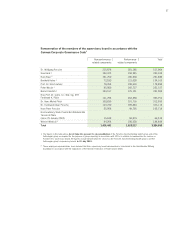

Significant rise in total unit sales

The Porsche Zwischenholding GmbH group

increased its unit sales by 8.8 percent to 81,850 ve-

hicles in the fiscal year 2009/10. This success also

reflects the successful debut of Porsche’s fourth

model: the Gran Turismo Panamera, launched on

markets worldwide in September 2009, achieved unit

sales of 20,615 vehicles by 31 July 2010. The eight-

cylinder models, the first to be introduced, reached a

total of 17,110 vehicles and the six-cylinder models

that followed in May 2010 came to 3,505 vehicles in

total. The Cayenne remained the best selling model

series, with unit sales reaching 29,855 vehicles. De-

spite the generation change in the sporty off-roader

made in the spring of 2010, this is a decrease of just

12.9 percent. The newest Cayenne, available on the

market since May 2010, already accounted for

11,618 vehicles sold. Overall, sales of the Cayenne in

the reporting period break down into 12,130 vehicles

with six-cylinder gasoline engines, 11,495 vehicles

with eight-cylinder engines and 6,230 vehicles with

diesel engines.

Sales of the 911 model series remained im-

pacted by the difficult economic conditions that con-

tinued to prevail in the sports cars market environ-

ment. Unit sales fell by 27.4 percent to 19,663 vehi-

cles for the period from 1 August 2009 to 31 July

2010. Nevertheless, Porsche was able to sell a total

of 4,055 of the new 911 Turbo and the 911 Turbo S,

which were available at dealers from November 2009

and May 2010 respectively. Unit sales of vehicles

from the Boxster model series, including the Cayman

models, dropped 10.8 percent to 11,717 vehicles. Of

these, 6,865 vehicles were Boxster vehicles and

4,852 Cayman vehicles.

The Volkswagen group was also able to in-

crease its unit sales. In the first six months of 2010 in

particular business developed much better than ex-

pected.

Due to the diverging fiscal year of the Volks-

wagen group, unit sales and production figures are

given separately below for the first half of the Porsche

SE fiscal year (including Volkswagen from 1 July to

31 December 2009, “first half of the year”) and for the

47