Holiday Inn 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS USEFUL INFORMATION

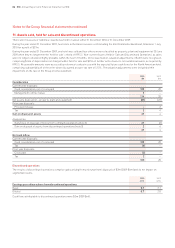

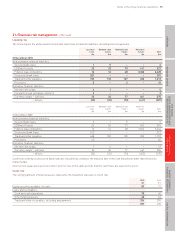

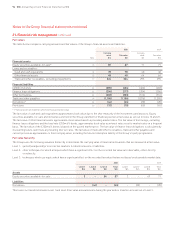

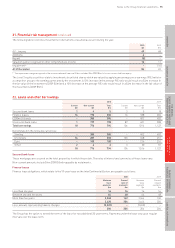

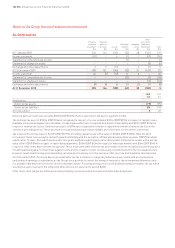

21. Financial risk management continued

The following table reconciles movements in instruments classified as Level 3 during the year:

2010 2009

$m $m

At 1 January 69 68

Additions 4 –

Repaid (5) –

Valuation gains recognised in other comprehensive income 16 11

Impairment* – (10)

At 31 December 84 69

* The impairment charge recognised in the income statement (see note 5) also includes $1m (2009 $4m) of losses reclassified from equity.

The Level 3 equity securities relate to investments in unlisted shares which are valued by applying an average price-earnings (P/E) ratio for

a competitor group to the earnings generated by the investment. A 10% increase in the average P/E ratio would result in a $4m increase in

the fair value of the investments (2009 $5m) and a 10% decrease in the average P/E ratio would result in a $4m decrease in the fair value of

the investments (2009 $5m).

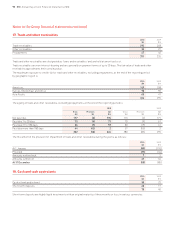

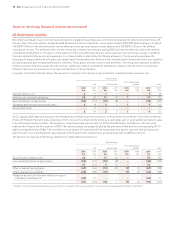

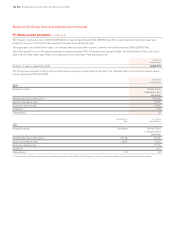

22. Loans and other borrowings

2010 2009

Current Non-current Total Current Non-current Total

$m $m $m $m $m $m

Secured bank loans 1 4 5 3 5 8

Finance leases 16 190 206 16 188 204

£250m 6% bonds – 385 385 – 402 402

Unsecured bank loans 1 197 198 87 421 508

Total borrowings 18 776 794 106 1,016 1,122

Denominated in the following currencies:

Sterling – 385 385 – 402 402

US dollars 16 287 303 103 348 451

Euro – 100 100 – 216 216

Other 2 4 6 3 50 53

18 776 794 106 1,016 1,122

Secured bank loans

These mortgages are secured on the hotel properties to which they relate. The rates of interest and currencies of these loans vary.

Non-current amounts include $4m (2009 $5m) repayable by instalments.

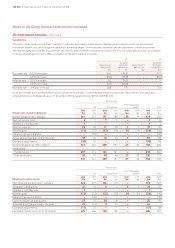

Finance leases

Finance lease obligations, which relate to the 99-year lease on the InterContinental Boston, are payable as follows:

2010 2009

Minimum Present Minimum Present

lease value of lease value of

payments payments payments payments

$m $m $m $m

Less than one year 16 16 16 16

Between one and five years 64 48 64 48

More than five years 3,348 142 3,364 140

3,428 206 3,444 204

Less: amount representing finance charges (3,222) – (3,240) –

206 206 204 204

The Group has the option to extend the term of the lease for two additional 20-year terms. Payments under the lease step up at regular

intervals over the lease term.

Notes to the Group financial statements 95