Holiday Inn 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS USEFUL INFORMATION

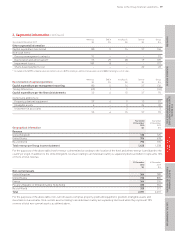

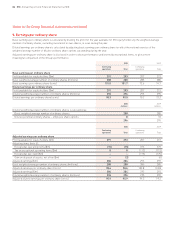

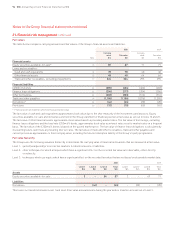

15. Other financial assets

2010 2009

$m $m

Non-current

Equity securities available-for-sale 87 66

Other 48 64

135 130

Current

Equity securities available-for-sale – 5

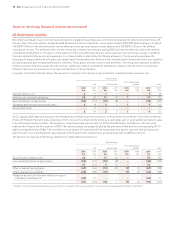

Available-for-sale financial assets, which are included in the Group statement of financial position at fair value, consist of equity

investments in listed and unlisted shares. Of the total amount of equity investments at 31 December 2010, $3m (2009 $2m) were listed

securities and $84m (2009 $69m) unlisted; $41m (2009 $39m) were denominated in US dollars, $17m (2009 $14m) in Hong Kong dollars

and $29m (2009 $18m) in other currencies. Unlisted equity shares are mainly investments in entities that own hotels which the Group

manages. The fair value of unlisted equity shares has been estimated using valuation guidelines issued by the British Venture Capital

Association and is based on assumptions regarding expected future earnings. Listed equity share valuation is based on observable market

prices. Dividend income from available-for-sale equity securities of $8m (2009 $7m) is reported as other operating income and expenses

in the Group income statement.

Other financial assets consist of trade deposits and restricted cash. These amounts have been designated as ‘loans and receivables’ and

are held at amortised cost. Restricted cash of $42m (2009 $47m) relates to cash held in bank accounts which is pledged as collateral to

insurance companies for risks retained by the Group.

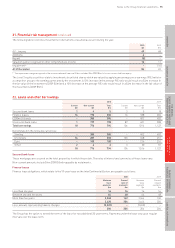

The movement in the provision for impairment of other financial assets during the year is as follows:

2010 2009

$m $m

At 1 January (25) (11)

Provided – exceptional items (note 5) (1) (14)

At 31 December (26) (25)

The amounts provided as exceptional items relate to available-for-sale equity investments and have arisen as a result of significant and

prolonged declines in their fair value below cost. In 2009, a deposit of $26m was also written off directly to the income statement as an

exceptional item (see note 5) as it is no longer considered recoverable under the terms of the related management contracts which are

deemed onerous.

The provision is used to record impairment losses unless the Group is satisfied that no recovery of the amount is possible; at that point the

amount considered irrecoverable is either written off directly to the income statement or, if previously provided, against the financial asset

with no impact on the income statement.

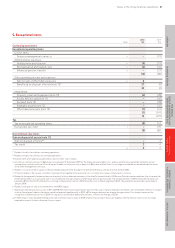

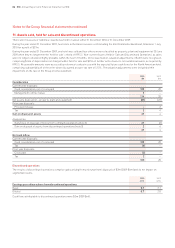

16. Inventories

2010 2009

$m $m

Finished goods 2 2

Consumable stores 2 2

4 4

Notes to the Group financial statements 89