Holiday Inn 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS USEFUL INFORMATION

Accounting policies 71

Basis of consolidation

The Group financial statements comprise the financial statements

of the parent company and entities controlled by the Company.

All intra-group balances and transactions have been eliminated.

The results of those businesses acquired or disposed of are

consolidated for the period during which they were under the

Group’s control.

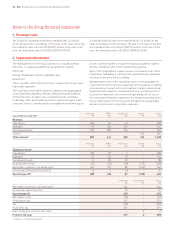

Foreign currencies

Transactions in foreign currencies are translated to the functional

currency at the exchange rates ruling on the dates of the

transactions. Monetary assets and liabilities denominated in

foreign currencies are retranslated to the functional currency at

the relevant rates of exchange ruling on the last day of the period.

All foreign exchange differences arising on translation are

recognised in the income statement except on foreign currency

borrowings that provide a hedge against a net investment in a

foreign operation. These are taken directly to the currency

translation reserve until the disposal of the net investment, at

which time they are recycled against the gain or loss on disposal.

The assets and liabilities of foreign operations, including goodwill,

are translated into US dollars at the relevant rates of exchange

ruling on the last day of the period. The revenues and expenses of

foreign operations are translated into US dollars at average rates

of exchange for the period. The exchange differences arising on

the retranslation are taken directly to the currency translation

reserve. On disposal of a foreign operation, the cumulative amount

recognised in the currency translation reserve relating to that

particular foreign operation is recycled against the gain or loss

on disposal.

Property, plant and equipment

Property, plant and equipment are stated at cost less depreciation

and any impairment.

Borrowing costs attributable to the acquisition or construction of an

asset that necessarily takes a substantial period of time to prepare

for its intended use or sale are capitalised as part of the asset cost.

All other borrowing costs are expensed as incurred. Borrowing

costs consist of interest and other costs that an entity incurs in

connection with the borrowing of funds. However, all borrowing

costs relating to projects commencing before 1 January 2009

were expensed.

Repairs and maintenance costs are expensed as incurred.

Land is not depreciated. All other property, plant and equipment

are depreciated to a residual value over their estimated useful

lives, namely:

buildings – lesser of 50 years and unexpired term of lease; and

fixtures, fittings and equipment – three to 25 years.

All depreciation is charged on a straight-line basis. Residual value

is reassessed annually.

Property, plant and equipment are tested for impairment when

events or changes in circumstances indicate that the carrying value

may not be recoverable. Assets that do not generate independent

cash flows are combined into cash-generating units. If carrying

values exceed their estimated recoverable amount, the assets

or cash-generating units are written down to the recoverable

amount. Recoverable amount is the greater of fair value less costs

to sell and value in use. Value in use is assessed based on estimated

future cash flows discounted to their present value using a pre-tax

discount rate that reflects current market assessments of the time

value of money and the risks specific to the asset. Impairment

losses, and any subsequent reversals, are recognised in the

income statement.

On adoption of IFRS, the Group retained previous revaluations of

property, plant and equipment at deemed cost as permitted by IFRS 1

‘First-time Adoption of International Financial Reporting Standards’.

Goodwill

Goodwill arises on consolidation and is recorded at cost, being the

excess of the cost of acquisition over the fair value at the date of

acquisition of the Group’s share of identifiable assets, liabilities

and contingent liabilities. With effect from 1 January 2010,

transaction costs are expensed and therefore not included in

the cost of acquisition. Following initial recognition, goodwill is

measured at cost less any accumulated impairment losses.

Goodwill is tested for impairment at least annually by comparing

carrying values of cash-generating units with their recoverable

amounts. Impairment losses cannot be subsequently reversed.

Intangible assets

Software

Acquired software licences and software developed in-house are

capitalised on the basis of the costs incurred to acquire and bring

to use the specific software. Costs are amortised over estimated

useful lives of three to five years on a straight-line basis.

Internally generated development costs are expensed unless forecast

revenues exceed attributable forecast development costs, at which

time they are capitalised and amortised over the life of the asset.

Management contracts

When assets are sold and a purchaser enters into a franchise or

management contract with the Group, the Group capitalises as

part of the gain or loss on disposal an estimate of the fair value of

the contract entered into. The value of management contracts is

amortised over the life of the contract which ranges from six to

50 years on a straight-line basis.

Other intangible assets

Amounts paid to hotel owners to secure management contracts and

franchise agreements are capitalised and amortised over the shorter

of the contracted period and 10 years on a straight-line basis.

Intangible assets are reviewed for impairment when events or

changes in circumstances indicate that the carrying value may not

be recoverable.