Holiday Inn 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 IHG Annual Report and Financial Statements 2010

Remuneration in 2011

During 2010, the Remuneration Committee spent a significant

amount of time considering more strategically relevant long-term

performance measures, which also drive shareholder value. Based

on this review and consultation with key institutional shareholders,

the Committee concluded that relative TSR remains well aligned

with the goal of achieving enduring top quartile returns; hence TSR

will continue to account for 50% of the LTIP weighting.

However, the Committee also resolved that the LTIP would be

better aligned with strategy by replacing EPS with two equally

weighted measures – net Rooms growth and like-for-like RevPAR

growth, both relative to major competitors.

Both net Rooms growth and RevPAR underpin IHG’s strategy

to drive shareholder value and have high relevance for most

employees. Net Rooms growth focuses on the goal to increase

system size. Like-for-like RevPAR growth reflects the importance

of revenue share, guest preference and overall brand strength.

After testing the performance conditions set on grant, the

Committee will review the vesting outcomes of the Rooms and

RevPAR measures against an assessment of earnings and quality

of the financial performance of the Company over the period. The

Committee may reduce the number of shares which vest if they

determine such an adjustment is appropriate. IHG’s performance

and vesting outcomes will be fully disclosed and explained in the

relevant Remuneration Report.

The Committee is determined that the overall incentive package

is based on an appropriate balance of performance measures.

Earnings growth continues to account for a significant part of

executive incentives, due to the 70% weighting of EBIT in the

Annual Bonus Plan (increased from 50% in 2009).

In addition, the following changes have been made to executive

remuneration arrangements for 2011:

• the maximum bonus opportunity will revert from 175% to 200%

of base salary;

• the EBIT target for maximum bonus achievement will revert from

120% to 110% of budget; and

• the maximum LTIP award will be maintained at 205% of base

salary.

In conclusion, the Committee believes that these changes will

lead to greater management focus on the key drivers of superior

performance, and that they are well aligned with the goal of

increasing shareholding value.

Ralph Kugler

Chairman of the Remuneration Committee

14 February 2011

Dear Shareholder

I am pleased to present the Directors’ Remuneration Report

for 2010.

The year started with significant uncertainty and volatility in the

economic environment. Early industry forecasts projected declining

revenue per available room (RevPAR) for 2010, including –4% for

the US market. However, by the end of 2010, the US market had

achieved 5.5% growth in RevPAR. Market conditions improved

progressively throughout the year as consumer confidence

strengthened.

For IHG, global RevPAR grew 6.2% and rates are now showing

positive growth in all regions. Other key performance indicators

also improved:

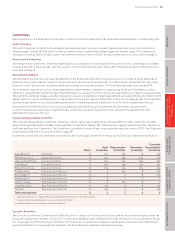

2010 Key performance indicator growth

(per annum) 2010 2009

Earnings before interest and tax (EBIT) +22.6% –34%

Revenue per available room (RevPAR) +6.2% –14.7%

Employee engagement +3% +1%

Three-year total shareholder return (TSR)* +8% –8.7%

Three-year adjusted earnings per share (EPS)* +9.6% +15.2%

* Annualised.

Based on these results, annual bonus outcomes in respect of 2010

were 175% of base salary. The Remuneration Committee believes

this to be an appropriate reflection of a strong recovery, noting that

results significantly exceeded expectation at the start of the year.

Remuneration in 2010

No annual bonus payments were made in respect of 2009. Robust

links between performance and reward were maintained in 2010

incentive plan designs. Targets were set at a challenging level in

relation to IHG’s strategic goals and to external analyst consensus.

In light of the high level of continuing uncertainty in the industry, the

Committee put in place the following safeguards for 2010 executive

remuneration:

Annual Bonus Plan (ABP)

• the maximum bonus opportunity was temporarily capped at

175% of base salary;

• the target for maximum bonus achievement was temporarily

increased from 110% to 120% for EBIT;

• the weighting of EBIT remained at 70% to ensure a continued

strong focus on earnings; and

• as first introduced in 2009, no bonus is payable if EBIT

performance is lower than 85% of target.

Long Term Incentive Plan (LTIP)

• maximum award levels were maintained at 205% of base salary

(previously 270%); and

• EPS and relative TSR performance measures were restored to

50% weighting each.

Salaries were increased by an average of 2.8% following no

increase in 2009.

The above actions were also applied to 2010 remuneration for

all other Executive Committee members.

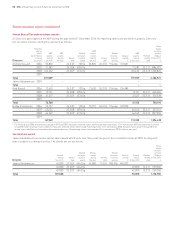

Remuneration report