Holiday Inn 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 IHG Annual Report and Financial Statements 2010

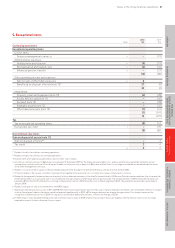

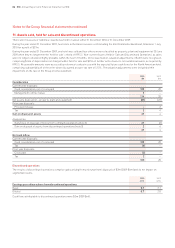

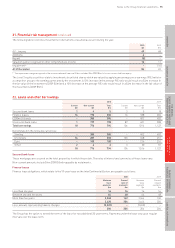

17. Trade and other receivables

2010 2009

$m $m

Trade receivables 292 268

Other receivables 32 27

Prepayments 47 40

371 335

Trade and other receivables are designated as ‘loans and receivables’ and are held at amortised cost.

Trade receivables are non-interest-bearing and are generally on payment terms of up to 30 days. The fair value of trade and other

receivables approximates their carrying value.

The maximum exposure to credit risk for trade and other receivables, excluding prepayments, at the end of the reporting period

by geographic region is:

2010 2009

$m $m

Americas 163 158

Europe, Middle East and Africa 98 90

Asia Pacific 63 47

324 295

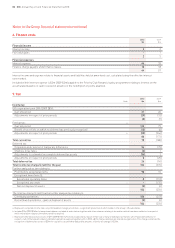

The ageing of trade and other receivables, excluding prepayments, at the end of the reporting period is:

2010 2009

Gross Provision Net Gross Provision Net

$m $m $m $m $m $m

Not past due 197 (3) 194 173 (2) 171

Past due 1 to 30 days 75 (4) 71 70 (9) 61

Past due 31 to 180 days 66 (9) 57 80 (19) 61

Past due more than 180 days 44 (42) 2 57 (55) 2

382 (58) 324 380 (85) 295

The movement in the provision for impairment of trade and other receivables during the year is as follows:

2010 2009

$m $m

At 1 January (85) (110)

Provided (27) (34)

Amounts written back 7 3

Amounts written off 47 56

At 31 December (58) (85)

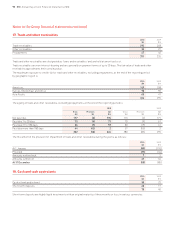

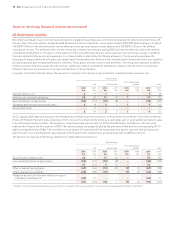

18. Cash and cash equivalents

2010 2009

$m $m

Cash at bank and in hand 38 23

Short-term deposits 40 17

78 40

Short-term deposits are highly liquid investments with an original maturity of three months or less, in various currencies.

Notes to the Group financial statements continued