Holiday Inn 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

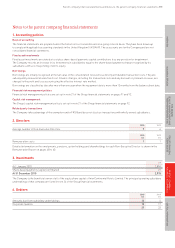

114 IHG Annual Report and Financial Statements 2010

Independent auditor’s report to the members of InterContinental Hotels Group PLC

We have audited the parent company financial statements of

InterContinental Hotels Group PLC for the year ended 31 December

2010 which comprise the parent company balance sheet and the

related notes 1 to 10. The financial reporting framework that has

been applied in their preparation is applicable law and United

Kingdom Accounting Standards (United Kingdom Generally

Accepted Accounting Practice).

This report is made solely to the Company’s members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

Company’s members those matters we are required to state to

them in an auditor’s report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company and the Company’s members

as a body, for our audit work, for this report, or for the opinions

we have formed.

Respective responsibilities of Directors

and auditor

As explained more fully in the Statement of Directors’ Responsibilities

set out on page 113, the Directors are responsible for the preparation

of the parent company financial statements and for being satisfied that

they give a true and fair view. Our responsibility is to audit and express

an opinion on the parent company financial statements in accordance

with applicable law and International Standards on Auditing (UK and

Ireland). Those standards require us to comply with the Auditing

Practices Board’s (APB’s) Ethical Standards for Auditors.

Scope of the audit of the financial statements

An audit involves obtaining evidence about the amounts and

disclosures in the financial statements sufficient to give reasonable

assurance that the financial statements are free from material

misstatement, whether caused by fraud or error. This includes an

assessment of: whether the accounting policies are appropriate to

the parent company’s circumstances and have been consistently

applied and adequately disclosed; the reasonableness of significant

accounting estimates made by the Directors; and the overall

presentation of the financial statements.

Opinion on financial statements

In our opinion the parent company financial statements:

• give a true and fair view of the state of the Company’s affairs as

at 31 December 2010;

• have been properly prepared in accordance with United Kingdom

Generally Accepted Accounting Practice; and

• have been prepared in accordance with the requirements of the

Companies Act 2006.

Opinion on other matters prescribed by the

Companies Act 2006

In our opinion:

• the part of the Remuneration Report to be audited has been

properly prepared in accordance with the Companies Act 2006;

and

• the information given in the Directors’ Report for the financial

year for which the financial statements are prepared is consistent

with the parent company financial statements.

Matters on which we are required to report

by exception

We have nothing to report in respect of the following matters

where the Companies Act 2006 requires us to report to you if,

in our opinion:

• adequate accounting records have not been kept by the parent

company, or returns adequate for our audit have not been

received from branches not visited by us; or

• the parent company financial statements and the part of the

Remuneration Report to be audited are not in agreement with

the accounting records and returns; or

• certain disclosures of Directors’ remuneration specified by law

are not made; or

• we have not received all the information and explanations we

require for our audit.

Other matter

We have reported separately on the Group financial statements

of InterContinental Hotels Group PLC for the year ended

31 December 2010.

Alison Baker (Senior statutory auditor)

for and on behalf of Ernst & Young LLP, Statutory Auditor

London

14 February 2011