Holiday Inn 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review continued

18 IHG Annual Report and Financial Statements 2010

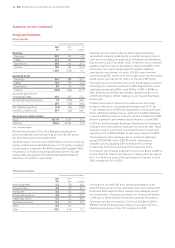

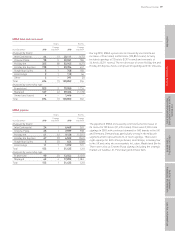

EMEA results

12 months ended 31 December

2010 2009 %

$m $m change

Revenue

Franchised 81 83 (2.4)

Managed 130 119 9.2

Owned and leased 203 195 4.1

Total 414 397 4.3

Operating profit before exceptional items

Franchised 59 60 (1.7)

Managed 62 65 (4.6)

Owned and leased 40 33 21.2

161 158 1.9

Regional overheads (36) (31) (16.1)

Total 125 127 (1.6)

EMEA comparable RevPAR movement on previous year

12 months ended

31 December 2010

Franchised

All brands 7.6%

Managed

All brands 3.3%

Owned and leased

InterContinental 11.4%

All ownership types

UK 3.8%

Continental Europe 10.1%

Middle East (1.0)%

Revenue increased by $17m to $414m (4.3%) and operating profit

before exceptional items decreased by $2m to $125m (1.6%).

At constant currency, revenue increased by $30m (7.6%) and

operating profit before exceptional items increased by $3m (2.4%).

Excluding $3m of liquidated damages received in 2009, revenue at

constant currency increased by 8.4% and operating profit by 4.8%.

Franchised revenue and operating profit decreased by $2m to

$81m (2.4%) and $1m to $59m (1.7%) respectively. At constant

currency, revenue increased by 1.2% and operating profit increased

by 1.7% respectively. Excluding the impact of $3m in liquidated

damages received in 2009, revenue and operating profit at constant

currency increased by 5.0% and 7.0% respectively. The underlying

increase was driven by RevPAR growth of 7.6% across the

franchised estate. Revenues associated with new signings,

relicensing and terminations decreased compared to 2009 as

real estate activity remained slow.

EMEA managed revenue increased by $11m to $130m (9.2%)

and operating profit decreased by $3m to $62m (4.6%).

At constant currency, revenue increased by 10.9% while operating

profit declined by 3.1%. Positive RevPAR growth in key European

cities and markets, including growth of 14.8% in IHG’s managed

properties in Germany, was offset by unfavourable trading across

much of the Middle East where RevPAR declined overall by 0.7%.

At the year end, a provision of $3m was made for future estimated

cash outflows relating to guarantee obligations for one hotel.

In the owned and leased estate, revenue increased by $8m to

$203m (4.1%) and operating profit increased by $7m to $40m

(21.2%), or at constant currency by 8.2% and 27.3% respectively.

RevPAR growth of 11.9% benefited from average daily rate growth

of 6.5% across the year. The InterContinental London Park Lane

and InterContinental Paris Le Grand delivered strong year-on-year

RevPAR growth of 15.0% and 11.5% respectively. Margins improved

in both these hotels as the focus remained on cost control.

Regional overheads increased by $5m to $36m (16.1%), mainly

attributable to performance-based incentive costs.

Europe, Middle East and Africa

EMEA strategic role 2011 priorities

To manage margins in a diverse and complex region; and seek

ways to achieve scale in key geographic areas.

• Execute our strategic plans of becoming a brand-led

business by delivering Great Hotels Guests Love and

increasing revenue share;

• drive growth strategies of our portfolio of brands in agreed

scale markets and key gateway cities;

• build upon the success of the Holiday Inn relaunch to

continue to grow the Holiday Inn brand family;

• deliver our People Tools to include the franchised estate; and

• support London 2012 Olympics.