Holiday Inn 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70 IHG Annual Report and Financial Statements 2010

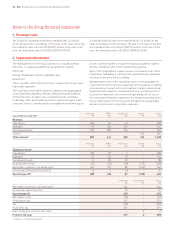

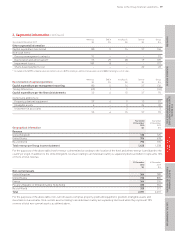

General information

The consolidated financial statements of InterContinental Hotels

Group PLC (the Group or IHG) for the year ended 31 December 2010

were authorised for issue in accordance with a resolution of the

Directors on 14 February 2011. InterContinental Hotels Group PLC

(the Company) is incorporated in Great Britain and registered in

England and Wales.

Summary of significant accounting policies

Basis of preparation

The consolidated financial statements of IHG have been prepared

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the European Union and as applied in

accordance with the provisions of the Companies Act 2006.

Changes in accounting policies

With effect from 1 January 2010, the Group has implemented

the following new accounting standards, amendments and

interpretations. None of these have had a material impact on the

Group’s financial performance or position during the year and there

has been no requirement to restate prior year comparatives.

• IFRS 3 (Revised) ‘Business Combinations’ changes the accounting

for transaction costs, the valuation of non-controlling interests,

the initial recognition and subsequent measurement of contingent

consideration, and business combinations achieved in stages.

These changes will impact the amount of goodwill recognised

and the reported results in the period when an acquisition occurs

and future reported results. These changes only apply to new

acquisitions and there have been none during the year.

• IAS 27 (Revised) ‘Consolidated and Separate Financial

Statements’ requires the effects of all transactions with non-

controlling interests to be recorded in equity if there is no change

in control and such transactions no longer result in goodwill or

gains and losses. The standard also specifies the accounting

when control is lost; any remaining interest in the entity is

remeasured to fair value with a gain or loss recognised in profit

or loss.

• IFRIC 17 ‘Distribution of Non-cash assets to Owners’ provides

guidance on accounting for arrangements where non-cash

assets are distributed to shareholders.

• IAS 39 (amendment) ‘Financial Instruments: Recognition and

Measurement – Eligible Hedged Items’ clarifies that an entity is

permitted to designate a portion of the fair value changes or cash

flow variability of a financial instrument as a hedged item. The

amendment also specifies that inflation is not a separately

identifiable risk and cannot be designated as the hedged risk

unless it represents a contractually specified cash flow.

• IFRS 2 (amendment) ‘Share-based Payment: Group Cash-settled

Share-based Payment Arrangements’ provides guidance on

accounting for inter-group cash-settled share-based payment

transactions in the separate financial statements of an entity.

• IFRS 5 (amendment) ‘Non-current Assets Held for Sale and

Discontinued Operations’ clarifies that disclosures required in

respect of non-current assets and disposal groups classified as

held for sale or discontinued operations are only those set out

in IFRS 5.

• IFRS 8 (amendment) ‘Operating Segments’ clarifies that segment

assets and liabilities need only be reported when included in

information reviewed by the chief operating decision maker.

• IAS 7 (amendment) ‘Statement of Cash Flows’ states that only

expenditure resulting in recognition of an asset can be presented

as a cash flow from investing activities.

• IAS 17 (amendment) ‘Leases’ clarifies that a lease of land should

be classified as an operating or finance lease in accordance with

the economic substance of the arrangement.

• IAS 36 (amendment) ‘Impairment of Assets’ clarifies that the

largest permitted unit for allocation of goodwill is the IFRS 8

operating segment before aggregation for reporting purposes.

• IFRIC 16 (amendment) ‘Hedges of a Net Investment in a Foreign

Operation’ removes the restriction on a hedged foreign operation

holding the hedging instruments.

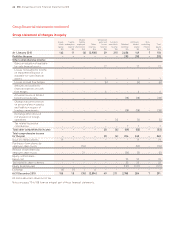

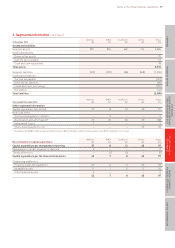

Changes in presentation

The Group statement of changes in equity has been expanded

to include an analysis of other comprehensive income by each

component of equity. The additional information is presented in

accordance with best practice and will become mandatory in 2011.

The fair values of derivative financial instruments are presented

separately on the face of the Group statement of financial position for

the first time (previously included within current ‘Trade and other

payables’) due to their increased materiality and in accordance with

best practice.

Net debt has been redefined to include the exchange element of

the fair value of currency swaps that fix the value of the Group’s

£250m 6% bonds. This change has been made to reflect the

commercial rationale of the hedging relationship. See notes 23

and 24 for further details.

Presentational currency

The consolidated financial statements are presented in millions

of US dollars following a management decision to change the

reporting currency from sterling during 2008. The change was

made to reflect the profile of the Group’s revenue and operating

profit which are primarily generated in US dollars or US dollar-

linked currencies.

The currency translation reserve was set to nil at 1 January 2004

on transition to IFRS and this reserve is presented on the

basis that the Group has reported in US dollars since this date.

Equity share capital, the capital redemption reserve and shares

held by employee share trusts are translated into US dollars at

the rates of exchange on the last day of the period; the resultant

exchange differences are recorded in other reserves.

The functional currency of the parent company remains sterling

since this is a non-trading holding company located in the United

Kingdom that has sterling denominated share capital and whose

primary activity is the payment and receipt of interest on sterling

denominated external borrowings and inter-company balances.

Accounting policies