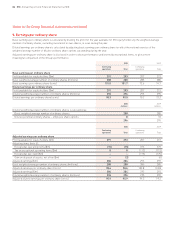

Holiday Inn 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW BUSINESS REVIEW

THE BOARD,

SENIOR MANAGEMENT AND

THEIR RESPONSIBILITIES

GROUP FINANCIAL

STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS USEFUL INFORMATION

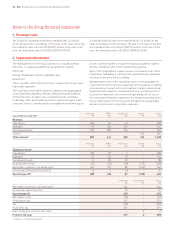

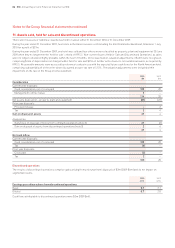

7. Tax continued

Before

Total

a exceptional itemsb

2010 2009 2010 2009

% % % %

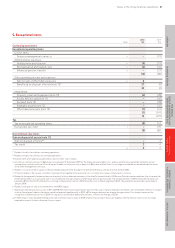

Reconciliation of tax charge/(credit), including gain

on disposal of assets

UK corporation tax at standard rate 28.0 28.0 28.0 28.0

Non-deductible expenditure and non-taxable income 4.1 (36.5) 4.2 7.4

Net effect of different rates of tax in overseas businesses 9.5 (43.0) 9.3 8.7

Effect of changes in tax rates (0.4) (0.3) (0.7) 0.1

Benefit of tax reliefs on which no deferred tax previously recognised (3.5) 7.2 (3.6) (1.5)

Effect of adjustments to estimated recoverable deferred tax assets (9.1) 5.9 (2.3) (1.2)

Adjustment to tax charge in respect of prior periods (11.2) 185.5 (9.1) (37.6)

Other – (3.8) – 0.8

Exceptional items and gain on disposal of assets 8.7 298.3 – –

26.1 441.3 25.8 4.7

a Calculated in relation to total profits/losses including exceptional items.

b Calculated in relation to profits excluding exceptional items.

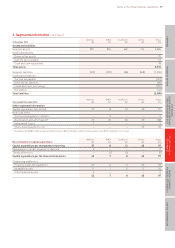

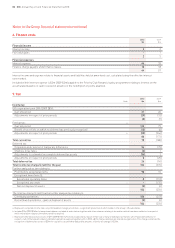

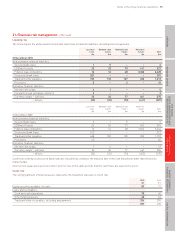

Tax paid

Total net tax paid during the year of $68m (2009 $2m) comprises $64m paid (2009 $1m paid) in respect of operating activities and $4m paid

(2009 $1m) in respect of investing activities.

Tax paid is lower than the current period income tax charge primarily due to the receipt of refunds in respect of prior years together with

provisions for tax for which no payment of tax has currently been made.

Tax risks, policies and governance

It is the Group’s objective to comply fully with its worldwide corporate income tax filing, payment and reporting obligations, whilst

managing its tax affairs within acceptable risk parameters on a basis consistent with the Group’s overall business conduct principles in

order to minimise its worldwide liabilities in the best interests of its shareholders. The Group adopts a policy of open co-operation with tax

authorities, with full disclosure of relevant issues.

The Group’s tax objectives and policies, and any changes thereto, are reviewed and approved by the Audit Committee. Regular tax reports

are made to the Chief Financial Officer in addition to an annual presentation to the Audit Committee covering the Group’s tax position,

strategy and major risks. Tax is also encompassed within the Group’s formal risk management procedures and any material tax disputes,

litigation or tax planning activities are subject to internal risk review and management approval procedures.

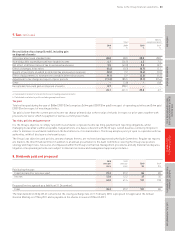

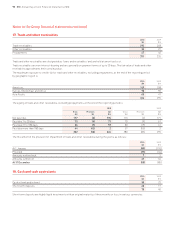

8. Dividends paid and proposed

2010 2009

cents per cents per 2010 2009

share share $m $m

Paid during the year:

Final (declared for previous year) 29.2 29.2 84 83

Interim 12.8 12.2 37 35

42.0 41.4 121 118

Proposed (not recognised as a liability at 31 December):

Final 35.2 29.2 101 84

The final dividend of 22.0p (35.2¢ converted at the closing exchange rate on 11 February 2011) is proposed for approval at the Annual

General Meeting on 27 May 2011 and is payable on the shares in issue at 25 March 2011.

Notes to the Group financial statements 83