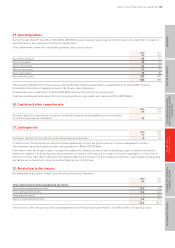

Holiday Inn 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 IHG Annual Report and Financial Statements 2010

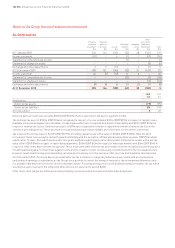

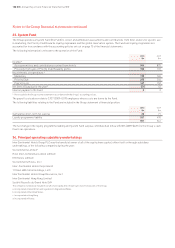

5. Creditors

2010 2009

£m £m

Amounts falling due within one year

Amounts due to subsidiary undertakings 2,147 2,048

Amounts falling due after more than one year

£250m 6% bonds 248 248

The 6% fixed interest sterling bonds were issued on 9 December 2009 and are repayable in full on 9 December 2016. Interest is payable

annually on 9 December in each year commencing 9 December 2010 to the maturity date. The bonds were initially priced at 99.465% of

face value and are unsecured.

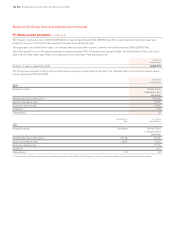

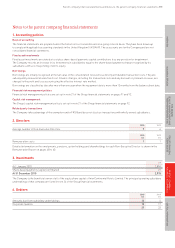

6. Share capital

At 30 September 2009, the authorised share capital was £160,050,000 comprising 1,175,000,000 ordinary shares of 1329⁄47p each and one

redeemable preference share of £50,000. As a result of the resolution passed at the Annual General Meeting on 29 May 2009 amending the

Articles of Association in line with the Companies Act 2006, from 1 October 2009 the Company no longer has authorised share capital.

Number

of shares

millions £m

Allotted, called up and fully paid (ordinary shares of 1329⁄47p each)

At 1 January 2010 287 39

Issued on exercise of share options 2 –

At 31 December 2010 289 39

The aggregate consideration in respect of ordinary shares issued under option schemes during the year was £12m (2009 £7m).

Thousands

Options to subscribe for ordinary shares

At 1 January 2010 5,870

Exercised* (2,497)

Lapsed or cancelled (82)

At 31 December 2010 3,291

Option exercise price per ordinary share (pence) 308.5-619.8

Final exercise date 4 April 2015

* The weighted average option price was 478.6p for shares exercised under the Executive Share Option Plan.

The authority given to the Company at the Annual General Meeting on 28 May 2010 to purchase its own shares was still valid at

31 December 2010. A resolution to renew the authority will be put to shareholders at the Annual General Meeting on 27 May 2011.

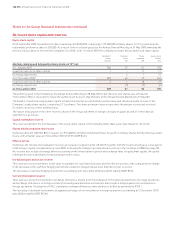

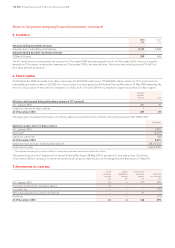

7. Movements in reserves

Share Capital Share-based

premium redemption payments Profit and

account reserve reserve loss account

£m £m £m £m

At 1 January 2010 49 6 127 399

Premium on allotment of ordinary shares 12 – – –

Loss after tax – – – (29)

Share-based payments capital contribution – – 21 –

Dividends – – – (77)

At 31 December 2010 61 6 148 293

Notes to the parent company financial statements continued