Foot Locker 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

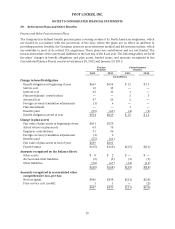

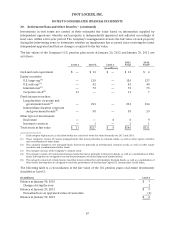

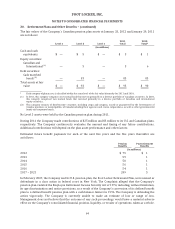

20. Retirement Plans and Other Benefits − (continued)

In addition, the Company maintains a Supplemental Executive Retirement Plan (‘‘SERP’’), which is an

unfunded plan that includes provisions for the continuation of medical and dental insurance benefits to

certain executive officers and certain other key employees of the Company (‘‘SERP Medical Plan’’). The

SERP Medical Plan’s accumulated projected benefit obligation at January 28, 2012 was approximately

$9 million. The assumed health care cost trend rates related to the measurement of the Company’s SERP

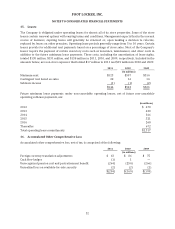

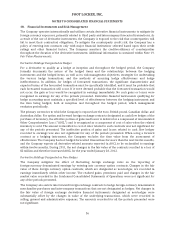

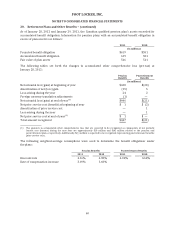

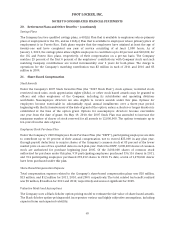

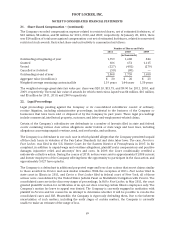

Medical Plan obligations for the year ended January 28, 2012 are as follows:

Medical Dental

Initial cost trend rate 8.00% 5.50%

Ultimate cost trend rate 5.00% 5.00%

Year that the ultimate cost trend rate is reached 2018 2013

A one percentage-point change in the assumed health care cost trend rates would have the

following effects:

1% Increase 1% (Decrease)

(in millions)

Effect on total service and interest cost components $ — $ —

Effect on accumulated postretirement benefit obligation 2 (2)

Plan Assets

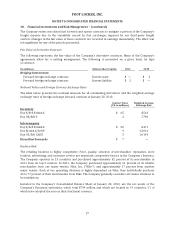

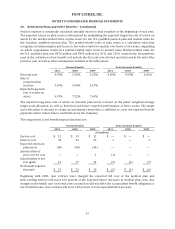

During 2011, the target composition of the Company’s U.S. plan assets was changed to represent

45 percent equity and 55 percent fixed-income securities. The Company may alter the targets from time to

time depending on market conditions and the funding requirements of the pension plan. This current asset

allocation will limit volatility with regard to the funded status of the plan, but will result in higher pension

expense due to the lower long-term rate of return associated with fixed-income securities. Due to market

conditions and other factors, actual asset allocations may vary from the target allocation outlined above.

The Company believes that plan assets are invested in a prudent manner with an objective of providing a

total return that, over the long term, provides sufficient assets to fund benefit obligations, taking into

account the Company’s expected contributions and the level of risk deemed appropriate. The Company’s

investment strategy seeks to utilize asset classes with differing rates of return, volatility, and correlation in

order to reduce risk by providing diversification relative to equities. Diversification within asset classes is

also utilized to ensure that there are no significant concentrations of risk in plan assets and to reduce the

effect that the return on any single investment may have on the entire portfolio.

The target composition of the Company’s Canadian plan assets is 95 percent debt securities and 5 percent

equity. The Company believes that plan assets are invested in a prudent manner with the same overall

objective and investment strategy as noted above for the U.S. pension plan. The bond portfolio is

comprised of government and corporate bonds chosen to match the duration of the pension plan’s benefit

payment obligations. This current asset allocation will limit future volatility with regard to the funded

status of the plan. This allocation has resulted in higher pension expense due to the lower long-term rate of

return associated with fixed-income securities.

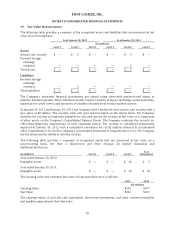

Valuation of Investments

Significant portions of plan assets are invested in commingled trust funds. These funds are valued at the

net asset value of units held by the plan at year end. Stocks traded on U.S. security exchanges are valued at

closing market prices on the measurement date.

62