Foot Locker 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

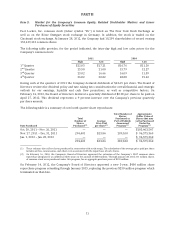

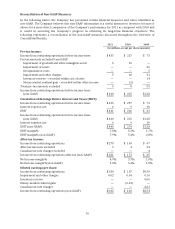

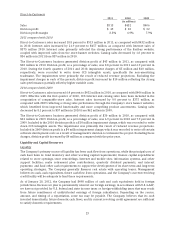

Item 6. Selected Financial Data

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

The selected financial data below should be read in conjunction with the Consolidated Financial

Statements and the Notes thereto and other information contained elsewhere in this report.

($ in millions, except per share amounts) 2011 2010 2009 2008 2007

Summary of Continuing Operations

Sales $5,623 5,049 4,854 5,237 5,437

Gross margin 1,796 1,516 1,332 1,460 1,420

Selling, general and administrative expenses 1,244 1,138 1,099 1,174 1,176

Impairment and other charges 5 10 41 259 128

Depreciation and amortization 110 106 112 130 166

Interest expense, net 6 9 10 5 1

Other income (4) (4) (3) (8) (1)

Income (loss) from continuing operations, after-tax 278 169 47 (79) 43

Per Common Share Data

Basic earnings 1.81 1.08 0.30 (0.52) 0.29

Diluted earnings 1.80 1.07 0.30 (0.52) 0.28

Common stock dividends declared per share 0.66 0.60 0.60 0.60 0.50

Weighted-average Common Shares Outstanding

Basic earnings 153.0 155.7 156.0 154.0 154.0

Diluted earnings 154.4 156.7 156.3 154.0 155.6

Financial Condition

Cash, cash equivalents, and short-term investments $ 851 696 589 408 493

Merchandise inventories 1,069 1,059 1,037 1,120 1,281

Property and equipment, net 427 386 387 432 521

Total assets 3,050 2,896 2,816 2,877 3,243

Long-term debt 135 137 138 142 221

Total shareholders’ equity 2,110 2,025 1,948 1,924 2,261

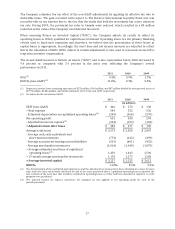

Financial Ratios

Sales per average gross square foot

(1)

$ 406 360 333 350 352

Earnings before interest and taxes (EBIT)

(2)

441 266 83 (95) (49)

EBIT margin

(2)

7.8% 5.3 1.7 (1.8) (0.9)

Net income margin

(2)

4.9% 3.3 1.0 (1.5) 0.8

Return on assets (ROA) 9.4% 5.9 1.7 (2.6) 1.3

Net debt capitalization percent

(3)

36.0% 39.0 43.0 46.7 45.1

Current ratio 3.8 4.0 4.1 4.2 4.0

Other Data

Capital expenditures $ 152 97 89 146 148

Number of stores at year end 3,369 3,426 3,500 3,641 3,785

Total selling square footage at year end (in millions) 7.38 7.54 7.74 8.09 8.50

Total gross square footage at year end (in millions) 12.45 12.64 12.96 13.50 14.12

(1) Calculated as Athletic Store sales divided by the average monthly ending gross square footage of the last thirteen months.

(2) Calculated using results from continuing operations.

(3) Represents total debt, net of cash, cash equivalents, and short-term investments. Additionally, this calculation includes the

present value of operating leases, and accordingly is considered a non-GAAP measure.

13