Foot Locker 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

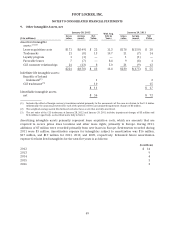

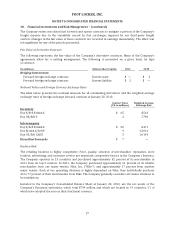

12. Revolving Credit Facility − (continued)

The 2011 Restated Credit Agreement provides for a security interest in certain of the Company’s domestic

assets, including certain inventory assets, but excluding intellectual property. The Company is not required

to comply with any financial covenants as long as there are no outstanding borrowings. With regard to the

payment of dividends and share repurchases, there are no restrictions if the Company is not borrowing

and the payments are funded through cash on hand. If the Company is borrowing, Availability as of the end

of each fiscal month during the subsequent projected six fiscal months following the payment must be at

least 20 percent of the lesser of the Aggregate Commitments and the Borrowing Base (as defined in the

2011 Restated Credit Agreement). The Company’s management does not currently expect to borrow under

the facility in 2012.

At January 28, 2012, the Company had unused domestic lines of credit of $199 million, while $1 million

was committed to support standby letters of credit. The letters of credit are primarily used for

insurance programs.

Deferred financing fees are amortized over the life of the facility on a straight-line basis, which is

comparable to the interest method. The unamortized balance at January 28, 2012 is $3 million.

The quarterly facility fees paid on the unused portion were 0.75 percent for both 2011 and 2010. Under

the terms of the 2011 Restated Credit Agreement, the quarterly facility fee will be 0.25 percent on the

unused portion. There were no short-term borrowings during 2011 or 2010. Interest expense, including

facility fees, related to the revolving credit facility was $4 million, $4 million, and $3 million for 2011, 2010,

and 2009, respectively.

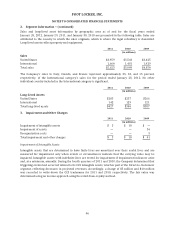

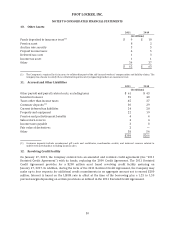

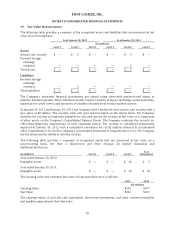

13. Long-Term Debt

The Company’s long-term debt reflects the Company’s 8.50 percent debentures payable in 2022, and was

$135 million and $137 million for the years ended January 28, 2012 and January 29, 2011, respectively.

Excluding the unamortized gain of the interest rate swaps of $15 million, the principal outstanding is

$120 million. The gain is being amortized as part of interest expense over the remaining term of the debt,

using the effective-yield method.

Interest expense related to long-term debt, including the effect of the interest rate swaps and the

amortization of the associated debt issuance costs, was $9 million for all years presented.

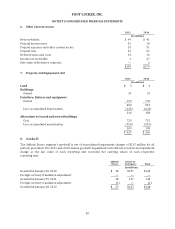

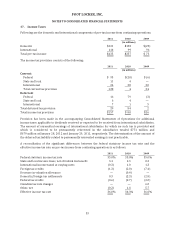

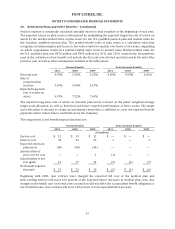

14. Other Liabilities

2011 2010

(in millions)

Straight-line rent liability $ 103 $ 100

Pension benefits 70 67

Income taxes 31 28

Postretirement benefits 14 11

Workers’ compensation and general liability reserves 11 11

Deferred taxes 5 —

Other 23 28

$ 257 $ 245

51