Foot Locker 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

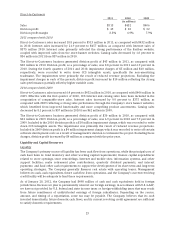

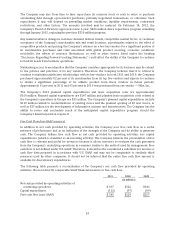

(5) Represents open purchase orders, as well as other commitments for merchandise purchases, at January 28, 2012. The Company

is obligated under the terms of purchase orders; however, the Company is generally able to renegotiate the timing and quantity

of these orders with certain vendors in response to shifts in consumer preferences.

(6) Represents payments required by non-merchandise purchase agreements.

The Company does not have any off-balance sheet financing, other than operating leases entered into in

the normal course of business as disclosed above, or unconsolidated special purpose entities. The

Company does not participate in transactions that generate relationships with unconsolidated entities or

financial partnerships, including variable interest entities. The Company’s policy prohibits the use of

derivatives for which there is no underlying exposure.

In connection with the sale of various businesses and assets, the Company may be obligated for certain

lease commitments transferred to third parties and pursuant to certain normal representations,

warranties, or indemnifications entered into with the purchasers of such businesses or assets. Although

the maximum potential amounts for such obligations cannot be readily determined, management believes

that the resolution of such contingencies will not significantly affect the Company’s consolidated financial

position, liquidity, or results of operations. The Company is also operating certain stores for which lease

agreements are in the process of being negotiated with landlords. Although there is no contractual

commitment to make these payments, it is likely that leases will be executed.

Critical Accounting Policies

Management’s responsibility for integrity and objectivity in the preparation and presentation of the

Company’s financial statements requires diligent application of appropriate accounting policies.

Generally, the Company’s accounting policies and methods are those specifically required by U.S.

generally accepted accounting principles. Included in the Summary of Significant Accounting Policies note

in ‘‘Item 8. Consolidated Financial Statements and Supplementary Data’’ is a summary of the Company’s

most significant accounting policies. In some cases, management is required to calculate amounts based on

estimates for matters that are inherently uncertain. The Company believes the following to be the most

critical of those accounting policies that necessitate subjective judgments.

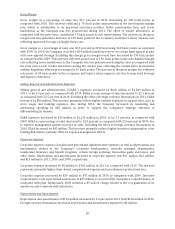

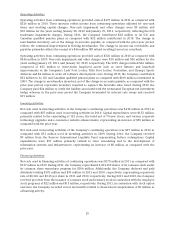

Merchandise Inventories

Merchandise inventories for the Company’s Athletic Stores are valued at the lower of cost or market using

the retail inventory method (‘‘RIM’’). The RIM is commonly used by retail companies to value inventories

at cost and calculate gross margins due to its practicality. Under the retail method, cost is determined by

applying a cost-to-retail percentage across groupings of similar items, known as departments. The

cost-to-retail percentage is applied to ending inventory at its current owned retail valuation to determine

the cost of ending inventory on a department basis. The RIM is a system of averages that requires

management’s estimates and assumptions regarding markups, markdowns and shrink, among others, and

as such, could result in distortions of inventory amounts.

Significant judgment is required for these estimates and assumptions, as well as to differentiate between

promotional and other markdowns that may be required to correctly reflect merchandise inventories at

the lower of cost or market. The Company provides reserves based on current selling prices when the

inventory has not been marked down to market. The failure to take permanent markdowns on a timely

basis may result in an overstatement of cost under the retail inventory method. The decision to take

permanent markdowns includes many factors, including the current environment, inventory levels, and

the age of the item. Management believes this method and its related assumptions, which have been

consistently applied, to be reasonable.

Vendor Reimbursements

In the normal course of business, the Company receives allowances from its vendors for markdowns taken.

Vendor allowances are recognized as a reduction in cost of sales in the period in which the markdowns are

taken. Vendor allowances contributed 30 basis points to the 2011 gross margin rate. The Company also

has volume-related agreements with certain vendors, under which it receives rebates based on fixed

percentages of cost purchases. These volume-related rebates are recorded in cost of sales when the

product is sold and were not significant to the 2011 gross margin rate.

28