Foot Locker 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

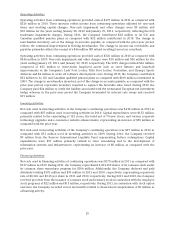

The Company receives support from some of its vendors in the form of reimbursements for cooperative

advertising and catalog costs for the launch and promotion of certain products. The reimbursements are

agreed upon with vendors for specific advertising campaigns and catalogs. Cooperative income, to the

extent that it reimburses specific, incremental and identifiable costs incurred to date, is recorded in SG&A

in the same period as the associated expenses are incurred. Cooperative reimbursements amounted to

approximately 18 percent and 11 percent of total advertising and catalog costs, respectively, in 2011.

Reimbursements received that are in excess of specific, incremental and identifiable costs incurred to date

are recognized as a reduction to the cost of merchandise and are reflected in cost of sales as the

merchandise is sold and were not significant in 2011.

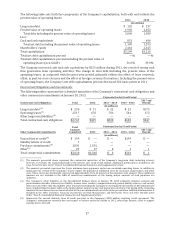

Impairment of Long-Lived Assets, Goodwill and Other Intangibles

The Company recognizes an impairment loss when circumstances indicate that the carrying value of

long-lived tangible and intangible assets with finite lives may not be recoverable. Management’s policy in

determining whether an impairment indicator exists, a triggering event, comprises measurable operating

performance criteria at the division level as well as qualitative measures. If an analysis is necessitated by

the occurrence of a triggering event, the Company uses assumptions, which are predominately identified

from the Company’s strategic long-range plans, in determining the impairment amount. In the calculation

of the fair value of long-lived assets, the Company compares the carrying amount of the asset with the

estimated future cash flows expected to result from the use of the asset. If the carrying amount of the asset

exceeds the estimated expected undiscounted future cash flows, the Company measures the amount of the

impairment by comparing the carrying amount of the asset with its estimated fair value. The estimation of

fair value is measured by discounting expected future cash flows at the Company’s weighted-average cost

of capital. Management believes its policy is reasonable and is consistently applied. Future expected cash

flows are based upon estimates that, if not achieved, may result in significantly different results.

The Company performs an impairment review of its goodwill and intangible assets with indefinite lives if

impairment indicators arise and, at a minimum, annually. We consider many factors in evaluating whether

the carrying value of goodwill may not be recoverable, including declines in stock price and market

capitalization in relation to the book value of the Company and macroeconomic conditions affecting retail.

The Company has chosen to perform this review at the beginning of each fiscal year, and it is done in a

two-step approach. The initial step requires that the carrying value of each reporting unit be compared

with its estimated fair value. The second step — to evaluate goodwill of a reporting unit for

impairment — is only required if the carrying value of that reporting unit exceeds its estimated fair value.

The Company used a combination of a discounted cash flow approach and market-based approach to

determine the fair value of a reporting unit. The determination of discounted cash flows of the reporting

units and assets and liabilities within the reporting units requires us to make significant estimates and

assumptions. These estimates and assumptions primarily include, but are not limited to, the discount rate,

terminal growth rates, earnings before depreciation and amortization, and capital expenditures forecasts.

The market approach requires judgment and uses one or more methods to compare the reporting unit

with similar businesses, business ownership interests or securities that have been sold. Due to the

inherent uncertainty involved in making these estimates, actual results could differ from those estimates.

The Company evaluated the merits of each significant assumption, both individually and in the aggregate,

used to determine the fair value of the reporting units, as well as the fair values of the corresponding

assets and liabilities within the reporting units, and concluded they are reasonable and are consistent with

prior valuations.

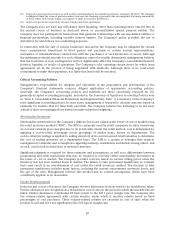

Owned trademarks and tradenames that have been determined to have indefinite lives are not subject to

amortization but are reviewed at least annually for potential impairment. The fair values of purchased

intangible assets are estimated and compared to their carrying values. We estimate the fair value of these

intangible assets based on an income approach using the relief-from-royalty method. This methodology

assumes that, in lieu of ownership, a third party would be willing to pay a royalty in order to exploit the

related benefits of these types of assets. This approach is dependent on a number of factors, including

estimates of future growth and trends, royalty rates in the category of intellectual property, discount rates,

and other variables. We base our fair value estimates on assumptions we believe to be reasonable, but

which are unpredictable and inherently uncertain. Actual future results may differ from those estimates.

We recognize an impairment loss when the estimated fair value of the intangible asset is less than the

carrying value.

29